Using Facebook’s Prophet, an open-source, time series forecasting procedure to predict SPY (SPDR S&P 500 ETF Trust) closing prices.

tl;dr

Goal

To apply Facebook's Prophet forecasting procedure to historical SPY (SPDR S&P 500 ETF Trust) market data to gather future pricing predictions.

A few notes

- I'm by no means a data scientist, so this is more of an exploratory analysis than an accurate one

- For sake of brevity, I won't be using a training/test split or measuring the error of the model, I will just train the model on the entire dataset and then make a prediction

Process overview

- Downloading the data - exporting the data from Yahoo Finance as a CSV

- Exploring the data - loading and exploring the data using Pandas

- Fitting the model - reading in the data and applying a basic fit of the Prophet model to the data

- Visualizing the forecast - visualizing the forecasted pricing data

Python dependencies

import pandas as pd

from prophet import Prophet

Important This article is not investment advice, please conduct your own due diligence. This is merely a simple analysis.

Before we jump in, let's give a little background on SPY and on Facebook's Prophet.

The SPDR S&P 500 ETF Trust (SPY) is an ETF (Exchange Traded Fund) that tracks the performance of the S&P 500 index. SPY is also the largest ETF in the world, and is popular compared to other ETFs that track the S&P 500 because of the high volume, or the number of shares that trade on a given day (we'll be able to see the volume per day in the CSV we export from Yahoo Finance).

For more information on ETFs, Investopedia gives a good overview.

Facebook Prophet is an open source, automated forecasting procedure for time series data. I'm not going to dive too much into the mathematics or implementation details of Prophet, but if you are more interested, you can read the research paper. Prophet makes it easy to handle outliers, adjust to different time intervals, deal with holidays, and leaves the ability to easily tune the forecasting model.

Now that we have a general idea of what we're trying to predict and the tool we'll use to forecast, let's dive into the actual data.

Downloading the data

Thanks to Yahoo Finance, we can download historical pricing data for free. You can click here to view the SPY historical pricing data.

Click on the Historical Data tab, and then we can adjust our Time Period to the Max as seen below (back to January 1993).

Now we can click download to get our CSV and start diving into the data.

Exploring the data

Let's fire up Pandas and load our data into a DataFrame to see what general insights we can extract.

df = pd.read_csv('SPY.csv')

# Columns and row count

df.info()

"""

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 7125 entries, 0 to 7124

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Date 7125 non-null object

1 Open 7125 non-null float64

2 High 7125 non-null float64

3 Low 7125 non-null float64

4 Close 7125 non-null float64

5 Adj Close 7125 non-null float64

6 Volume 7125 non-null int64

dtypes: float64(5), int64(1), object(1)

memory usage: 389.8+ KB

"""

# Preview of the data

df.head()

"""

Date Open High Low Close Adj Close Volume

0 1993-01-29 43.96875 43.96875 43.75000 43.93750 25.884184 1003200

1 1993-02-01 43.96875 44.25000 43.96875 44.25000 26.068277 480500

2 1993-02-02 44.21875 44.37500 44.12500 44.34375 26.123499 201300

3 1993-02-03 44.40625 44.84375 44.37500 44.81250 26.399649 529400

4 1993-02-04 44.96875 45.09375 44.46875 45.00000 26.510111 531500

"""

# General statistics

df.describe().loc[['mean', 'min', 'max']]

"""

Open High Low Close Adj Close Volume

mean 146.896395 147.766581 145.928716 146.896373 121.611954 8.453727e+07

min 43.343750 43.531250 42.812500 43.406250 25.571209 5.200000e+03

max 422.500000 422.820007 419.160004 422.119995 422.119995 8.710263e+08

"""

# Day to day percent changes of Highs

df[['Date', 'High']].set_index('Date').pct_change().reset_index()

"""

Date High

0 1993-01-29 NaN

1 1993-02-01 0.006397

2 1993-02-02 0.002825

3 1993-02-03 0.010563

4 1993-02-04 0.005575

... ...

7120 2021-05-10 -0.000189

7121 2021-05-11 -0.017670

7122 2021-05-12 -0.006454

7123 2021-05-13 -0.000582

7124 2021-05-14 0.012465

[7125 rows x 2 columns]

"""

Now that we know a bit more about our data in general, we can create a model using Prophet.

Fitting the model

Since we're not concerned in this post about making our model the best it can be, we can train our model on the entire dataset.

This typically isn't a good practice. When trying to make an accurate prediction, you should use training and test subsets of the data and calculate errors within your model and use those results to tune hyperparameters.

Nevertheless, let's continue.

# The prophet model fits to a DataFrame with a date column (ds)

# and a value to predict (y)

df_predict = df[['Date', 'Close']]

df_predict.columns = ['ds', 'y']

# We can find all of the missing days within our dataset

# and mark those as "holidays"

date_series = pd.to_datetime(df['Date'])

df_missing_dates = pd\

.date_range(start=date_series.min(), end=date_series.max())\

.difference(date_series)\

.to_frame()\

.reset_index()

df_missing_dates.columns = ['holiday', 'ds']

df_missing_dates['holiday'] = 'Stock Market Closed'

# Fitting our model is incredibly simple and can be done in the

# most basic sense in just two lines of code

m = Prophet(daily_seasonality=True, holidays=df_missing_dates)

m.fit(df_predict)

Just like that, we have built our model for a forecast. All we have left to do is generate dates to predict values for, and run the actual prediction.

Visualizing the forecast

Now let's forecast with our model and visualize the results.

# Create a DataFrame with past and future dates (only weekdays)

future = m.make_future_dataframe(periods=365)

future = future[pd.to_datetime(future['ds']).dt.weekday < 5]

# Now we can forecast and visualize in just two more lines of code

forecast = m.predict(future)

m.plot(forecast, xlabel='Date', ylabel='Daily Closing Price')

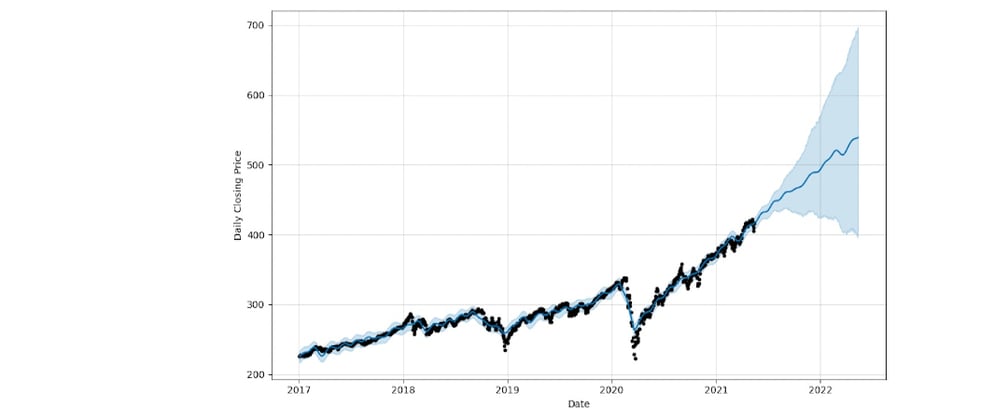

A few things to notice

- The black dots are the training data points

- The blue outline is the confidence interval

- The line within the confidence interval is the actual forecast

Based on our results, we can see the forecast is fairly linear and the confidence interval is relatively narrow (due to the volume of date). The behavior of the stock market since Covid-19 started back around February 2020 has be a little unorthodox, so let's narrow our model to be trained back to data starting in 2017 to see if there is an effect.

# Narrow down to start at 2017

df_recent_predict = df_predict.iloc[date_series[date_series.dt.year > 2016].index]

date_series = pd.to_datetime(df_recent_predict['ds'])

df_recent_missing_dates = pd\

.date_range(start=date_series.min(), end=date_series.max())\

.difference(date_series)\

.to_frame()\

.reset_index()

df_recent_missing_dates.columns = ['holiday', 'ds']

df_recent_missing_dates['holiday'] = 'Stock Market Closed'

# Create and fit our new model

m = Prophet(daily_seasonality=True, holidays=df_recent_missing_dates)

m.fit(df_recent_predict)

# Recreate our future predictions

future = m.make_future_dataframe(periods=365)

future = future[pd.to_datetime(future['ds']).dt.weekday < 5]

# Forecast and visualize

forecast = m.predict(future)

m.plot(forecast, xlabel='Date', ylabel='Daily Closing Price')

Now we can see a much wider confidence interval and a bit more of a bumpy forecast line; however, this looks much more realistic in terms of stock market prediction.

Conclusion

All in all, Facebook's Prophet is a very fast, impressive, and strongly abstracted library. The entire script, including reading in the data, training and forecasting two models, and plotting both of the forecasts took right around 25 seconds.

I would love to see this tool in the hands of an actual data scientist to see the accuracy of the models they'd be able to create using Prophet.

Top comments (0)