The possibility of a market crash increases

We'll bring you an analysis of the latest economic and crypto news to understand how this week's events impact your investments.

summary: Last week was marked by a series of significant events in the economic and cryptocurrency sectors. News from President Trump continues to move the market, and the S&P 500 registered one of its fastest corrections in history. Globally, a slowdown is anticipated due to all the trade tensions and protectionist policies taking place in several countries. The crypto sector has seen a brief respite and recovery after all the declines of last week, while altcoins continue to experience losses. The market in general has shown high volatility, reflected in the Fear and Greed Index. There are plenty of facts to analyze before getting into the subject:

Main economic news this week:

Legislative debates on stablecoin regulations in the US

Between March 10 and 14, the US Senate Banking Committee (which oversees the financial services industry in the US) voted on a bill aimed at clarifying regulations for stablecoins (USDC, USDT, FDUSD). The bill represents a step forward in adoption, generating very good expectations within the crypto and institutional community, which is now betting on the launch of more ETFs by 2025.

Cryptocurrency roundtable organized by the SEC

On March 21, the US Securities and Exchange Commission (SEC, formerly headed by Gary Gensler, who left after Trump's inauguration) will hold its first roundtable on cryptocurrencies, in a new phase of crypto-friendliness, breaking away from Mr. Gensler's previous policies. The objective is to analyze current regulations, market stability, and the integration of digital assets into traditional financial systems. The event seeks to follow the line of last week's political discourse at the White House Crypto Summit. The idea is to address the challenges facing the cryptocurrency market and how to ensure safer regulation for all users and companies that wish to participate.

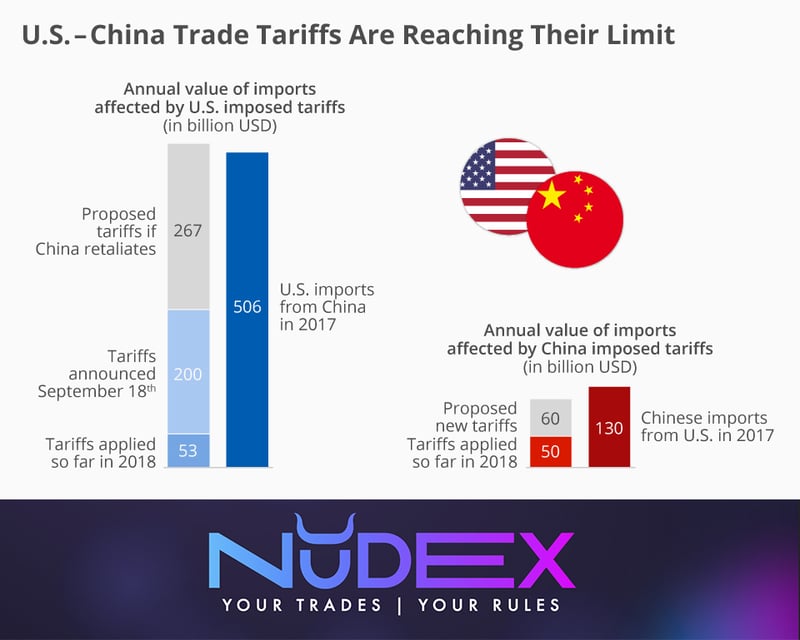

Escalation of the Trade War between the United States and China

On March 10, China implemented tariffs of 10% and 15% on US agricultural products in response to the 20% tariffs imposed by President Trump on Chinese products (tariffs that add to the list of economic attacks in recent weeks). These measures have intensified trade tensions between the two powers, which is why the main markets showed sharp declines in their values. Wall Street continues to await any news that may emerge from these tariffs, as new percentages are stipulated each week and more tariffs are applied to new products.

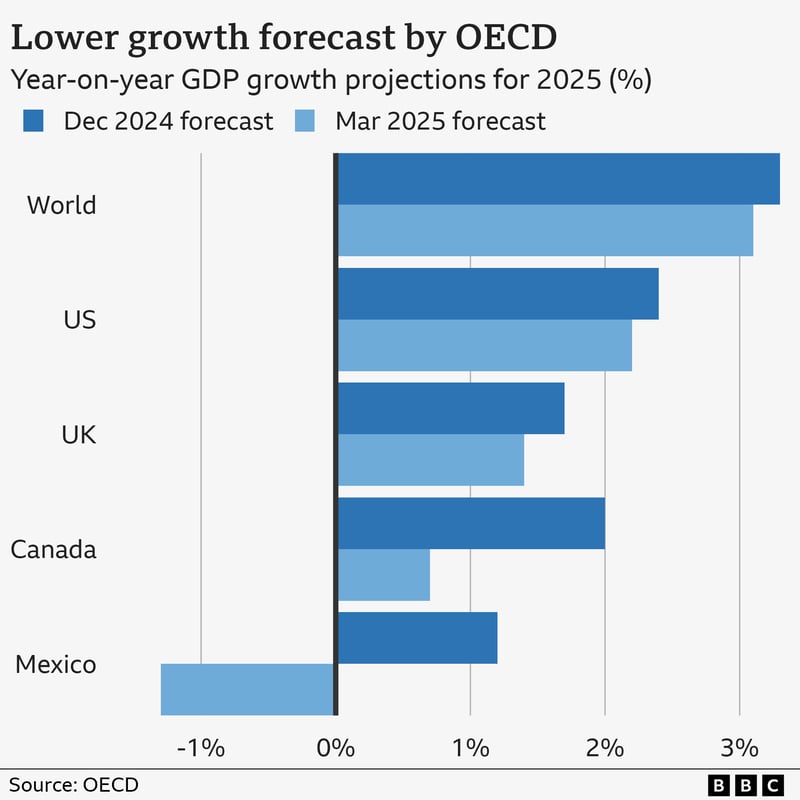

OECD Downward Revision of Global Economic Growth

The Organization for Economic Cooperation and Development (OECD) revised its global growth forecasts, reducing the expectation to 3.1% for 2025, as all the economic tensions and uncertainties are beginning to show discouraging results for investors. This downward revision is further reflected in concerns about the impact of new protectionist policies and the new trade tensions that are developing globally.

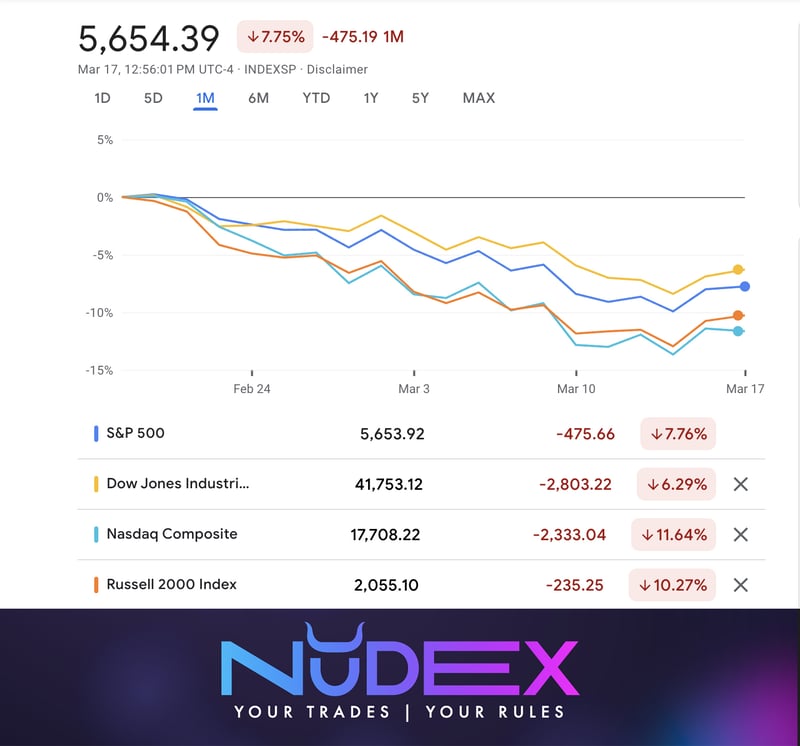

Financial Markets Decline Due to Recession Fears

Stock markets on Wall Street and in Europe saw declines this week that are already entering the correction zone (more than -10%), reflecting investor nervousness about the possibility of an economic recession. For example, the Dow Jones Industrial Average closed down 1.48%, while the S&P 500 lost 1.76%, the largest daily drop of the year. The Nasdaq Composite dropped -2.64% on average across all days of the week, resulting in a cumulative decline of -10% below historic highs.

The OECD also warned of an increase in global inflation, which could lead to more restrictive monetary policies and adjustments in financial markets. This week, on Wednesday the 19th, we have the Fed meeting. The market is already pricing in the end of restrictive policies for the May meeting, but expectations for rising inflation conflict with these estimates. Ultimately, uncertainty seems to be even greater, and volatility is growing week by week.

Top Crypto News

Coinbase Pro Adds Support for Cardano (ADA)

Coinbase Pro announced that it will enable Cardano (ADA) trading starting March 13, subject to liquidity conditions. Following the announcement, ADA experienced a 16% increase in less than an hour. Recall that Cardano increased by more than 90% the day Trump announced the cryptocurrency strategic reserve. ADA was the best-performing coin following that news. Although it reversed some of its rise, it still achieved a significant appreciation compared to February.

Japan Launches Digital Yen Pilot

The Bank of Japan (BoJ) confirmed the launch of a pilot for the digital yen in the coming weeks, highlighting the importance of central banks preparing for the implementation of digital currencies. It joined the list of countries already beginning to develop their own CBDCs. This week, the ECB also discussed its CBDC and said it expects to have its own digital currency up and running by October of this year.

South Korea Issues Blockchain-Based Vaccination Certificates

South Korea has made progress in its COVID-19 vaccination program, issuing digital certificates based on blockchain technology to guarantee the authenticity and security of vaccination records being issued in the country. In this case, we see a practical use of blockchain beyond financial speculation, a very important measure to continue building credibility in mass adoption.

Gemini Surpasses $20 Billion in Crypto Assets Under Custody

The Gemini exchange announced that it has doubled the amount of crypto assets under its custody in two months, surpassing $20 billion, reflecting an increase in institutional adoption of cryptocurrencies. It's worth noting that Gemini is owned by the Winklevoss brothers, who have been Bitcoin advocates since its early days. The same brothers who sued Mark Zuckerberg for the creation of Facebook.

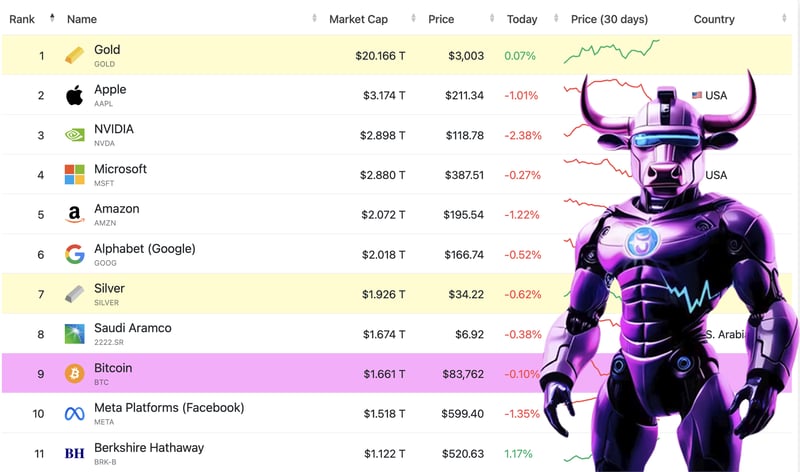

Bitcoin Market Cap Surpasses Visa and Mastercard Combined

Bitcoin's market cap has reached approximately $1.15 trillion, surpassing the combined market capitalizations of Visa and Mastercard. This consolidates its position in the global financial system. Bitcoin is among the top 10 assets with the highest market cap, behind gold, Google, Amazon, and Apple.

Volatility in financial markets has seen increased volatility this week, influenced by trade tensions and declining economic growth expectations. Traditional volatility has been above 20 points for the second consecutive week. Any time it remains above 20, it is considered a high volatility zone.

Fear and Greed Index:

This week, the Fear and Greed Index stood at 45, indicating a moderate sense of fear in the crypto market.

The 5 Cryptocurrencies That Gained This Week

Bitcoin (BTC): Increased 2.23% this week.

Dogecoin (DOGE): Increased 2.35% in recent days.

Polkadot (DOT): Increased 3.31% during the week.

Litecoin (LTC): Increased 4.57% in value.

Uniswap (UNI): Up 2.82% over the past seven days.

The 5 biggest losing cryptocurrencies of the week

Ethereum (ETH): Loss of over 10% this week

Binance Coin (BNB): Decrease of 5.38% in value.

Solana (SOL): Decrease of 0.95% during the week.

Polygon (MATIC): Decrease of 1.29% in the past seven days.

Cardano (ADA): Loss of 2.64% in value.

Top comments (1)

Crypto is evolving fast, and it’s getting harder to keep up with everything—especially with new tokens, regulations, and market shifts happening almost daily. I’ve been following updates closely and sharing key insights through my blog to help others stay informed. If you're also exploring the space, check out Coinography for accurate and up-to-date crypto news.