title: [Book Sharing] The Most Important Thing - A Book Warren Buffett Read Twice

published: false

date: 2022-02-11 00:00:00 UTC

tags:

canonical_url: http://www.evanlin.com/the-most-important-thing/

---

[](http://moo.im/a/03tvxZ "The Most Important Thing")

[Book Sharing] The Most Important Thing: A Book Warren Buffett Read Twice

The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor

Author: Howard Marks

Original Author: Howard Marks

Translator: Su Pengyuan

Publisher: Business Weekly

Publication Date: 2017/02/23

#### Recommended Purchase Links:

- [Readmoo eBook Purchase](http://moo.im/a/03tvxZ)

# Preface:

This is the second book I finished reading in 2022. This book is considered by many to be the most important investment bible and is also considered by many to be an introductory textbook for investment. Although everyone says it's super classic, this book was in my shopping cart for a long time without being ordered (because there are really too many investment books to read). But after going to Eslite and quickly flipping through it on the second day of the Lunar New Year, I was immediately attracted by its chapter descriptions. Just seeing "Second-Level Thinking" and "Counteracting the Effects of Emotions" benefited me immensely. This is a book on the cultivation of investment mindset. It teaches the basic mentality that investors should have and also points out some common mistakes investors make, which will be really useful.

# Content Summary and Thoughts:

Buffett: I read this book twice!

The Wall Street Journal: His memos are comparable to Berkshire's shareholder meetings.

A must-read classic for value investors—20 investment rules by Howard Marks

Legendary master distills the most important things in investment,

Value-added notes from 4 top investment experts,

Whether you are a beginner or a veteran, you can find your own winning method from the master's insights!

Howard Marks, who is as famous as Buffett in the US investment world, co-founded Oaktree Capital, which has been established for more than twenty years and manages assets of over a hundred billion US dollars. Its long-term performance is even more astonishing. Over the past twenty-eight years (including the six founders' tenure at TCW), the average compound return has reached 19% (during the same period, the S&P 500 index in the US stock market only performed 10.1%, and the MSCI World Index only performed 4.9%). In other words, if you had entrusted one million to Oaktree Capital to manage twenty-eight years ago, you would now have 170 million.

Howard Marks never hesitates to share his investment insights with the market and continues to communicate with clients and all investors through "Investment Memos." Oaktree's memos are highly valued by the US investment community and are equivalent to Buffett's Berkshire Hathaway's annual shareholder meetings. Even Buffett himself rarely endorses: "As long as I see Howard Marks' investment memos in my email inbox, I will immediately open and read them!"

## Chapter Outline

### Chapter 1 Learning Second-Level Thinking

Many investors have basic market concepts (and of course, others in the investment market do too). For example, they chase high prices frantically when they see good financial reports and sell when they see bad financial reports. But the first chapter of this book tells you to have "second-level thinking," which means to break away from the thinking of the general public in investment. Because our main idea in investing is to "beat the market," we can also say to profit in the investment market, then you need to have second-level thinking:

- First-level thinking: See a good company, buy this stock.

- Second-level thinking will think, although it is a good company, but is the current stock price too high? Will there be a risk of a pullback?

Second-level thinking is not meaningless opposition, but requires you to carefully review the information from the first-level thinking and examine every risk thoroughly, so that you can obtain higher profits.

### Chapter 2 Understanding Market Efficiency and Limitations

The "definition of an efficient market" is that you cannot easily beat the market because all investors in the market are professional investors. The prices accumulated by these investors' joint efforts have relevant credibility. In the New York Stock Exchange, how many possibilities are there for a stock that all investors are bearish on to be misvalued? Conversely, "inefficient markets" define the opposite market conditions. The real situation is that the market can efficiently reflect the value a stock should have, but sometimes it will also inefficiently "misjudge" the true value of a certain stock.

### Chapter 3 Accurately Estimating Intrinsic Value (Value Investing and Growth Stock Investing)

So how do you find valuable stocks in an "inefficient market" and wait for the market to turn to "efficient market" and give it its true value? This explains two key points: "Value Investing" and "Growth Stock Investing."

**Value Investing**: Buys stocks because they believe the current value is relatively higher than the current stock price. They will still invest even if there is no future growth.

- Don't have to believe in the future

- Deduce company value through objective data

- Pursue a match between stock price and value

- Add more when the stock price falls (because it becomes cheaper)

**Growth Stock Investing**: Buys stocks because they are optimistic about future growth value, even if the current value is far lower than the original stock price.

- Only care about the future

- Have subjective data in certain aspects to determine the company's growth

- Pursue explosive growth

- When the stock price falls, re-examine whether the growth momentum and growth factors still exist.

### Chapter 4 Finding the Relationship Between Price and Value

Success is not because you bought a good target. It's because you bought that good target at the right price.

"Successful investment is not because you 'bought a good thing', but because you 'bought the thing well'."

The safest investment is: Buy when no one likes it, and when the investment target becomes popular, its price will only rise all the way.

Choosing good investment targets is very important, but what's more important is how to buy at the right price. Because buying at the right price can bring:

- Higher win rate (adjusted stock price, easier to profit)

- Lower-risk investment (even if you lose, you may not lose too much)

- Investing that doesn't get better by using leverage, but instead easily increases risk.

Every bubble is born with a few points of truth, whether it's:

- The Dutch tulips of the seventeenth century

- The internet companies of the two thousand years

- The 2008 mortgage crisis

They all have a few points of real profit and incentives, but the risks are all explored within them.

### Chapter 5 Understanding Risk

Risk means that more things can happen than will happen.

- Elory Dimson, Professor at London Business School

The first thing in investing is to understand `no one can accurately know the future`, so there are bound to be risks, and investment should be built on the lowest risk.

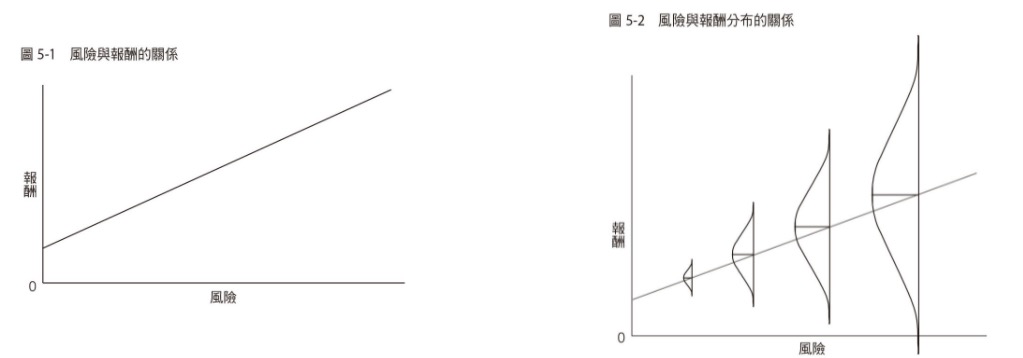

#### Risk and Reward

- Risk is bad, please avoid unnecessary risks

- Risk is related to profit, find appropriate risk and reward through equilibration.

- The investment result should be the result of combining risk and reward.

We all think that risk and reward are 5-1, but the real risk and reward distribution is like 5-2. Under the same risk conditions, according to different investment strategies, there can actually be two extreme reward distributions. (Positive is quite large, which means making a lot of money; conversely, it means huge losses).

A few things to summarize:

- Risk is difficult to judge, there are various implied statistical indicators, but it is still difficult to have obvious quantitative methods.

- Investment is to deal with the future and understand that risk will definitely happen.

- In the allocation of the investment portfolio, it is necessary to evaluate the maximum loss situation if risk occurs. As a means of risk control.

### Chapter 6 Confirming Risk

Knowing that risk is inevitable, let's start confirming the nature of risk:

- Risk will only be dispersed, not disappear.

- As long as the market environment changes, risk needs to be re-evaluated

- The capriciousness of risk: Risk will also change with the madness of investors

### Chapter 7 Controlling Risk

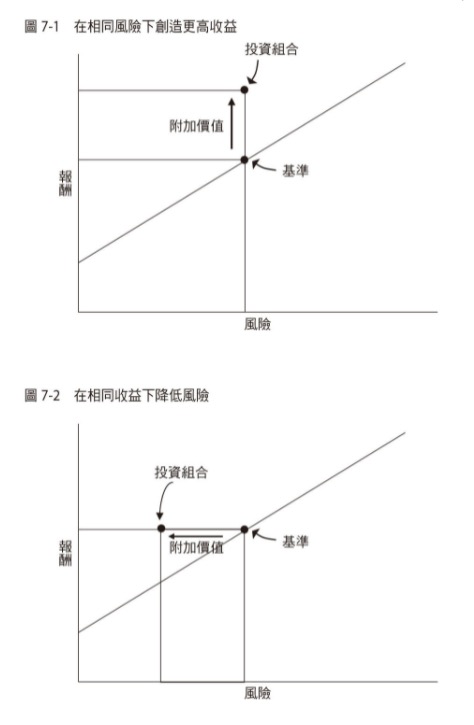

The most important task for investors is to bear risk for profit,

The difference between the best investors and others is that they can do this best. (Refers to minimizing risk as much as possible).

I think this chart is one of the most important concepts in this book.

Everyone thinks that good investors are like 7-1, adding value under the same risk. But `the truly great investors are those who can minimize risk under the same profit`. Because in an inefficient market, investors who can reduce the lowest risk can lock in profits and have better investment results.

For example, for life insurance companies:

- Every policyholder will definitely die, so the insurance policy will definitely compensate.

- Through actuarial science, insurance companies can reasonably bear the risk and adjust premiums through health conditions to reduce the risk to the lowest.

- As long as the conditions are reasonable, all policyholders can profit through actuarial calculations.

**Risk cannot be avoided, only controlled**

- A 40% loss requires a 67% return to break even.

- A more advanced 50% loss requires a 100% return the following year to break even.

Risk control is very important.

### Chapter 8 Pay Attention to Economic Cycles

#### Credit Cycle

- The economy enters prosperity

- A lot of funds

- Everyone invests crazily, risk aversion decreases

- Competing for the market, financial institutions lower interest rates

- Defaults begin to occur

- Lending conditions increase

- Funds become less

- Economic contraction

Economic cycles will not stop, but there will be varying lengths.

### Chapter 9 Be Aware of the Pendulum Effect

Economic cycles are like a pendulum, and there must be related highs and lows. But what makes investors unclear is that the intermediate state is often quite long.

#### Three Phases of a Bull Market

- A few people think things will get better

- Most investors think it's getting better

- News and everyone think it's getting better

Then comes the beginning of a bear market.

Those who believe in the pendulum effect need to understand that fear and greed are the two high points of the pendulum. But most are in the middle of the two high points, and extreme markets will definitely reverse.

### Chapter 10 Counteracting the Negative Effects of Emotions

Greed will make investors forget about risk. Fear is the opposite of greed and will make people overly worried.

#### Seven Mindsets of Wrong Investment

- Greed

- Fear

- Throwing doubts to the back of your mind

- The tendency to follow the crowd (herd effect)

- Envy

- Arrogance

- Surrender

If things are too good to be true, it means that it's definitely not true. (That is, there are bubbles and risks)

### Chapter 11 Contrarian Investing

Buy when others are abandoning, and sell when they are excited. It all requires the greatest courage, but it will also provide the richest profits.

- Sir John Templeton

Contrarian investing has a very high risk:

- The market does not often present extreme situations that allow you to profit, and following contrarian investing often leads to losses.

- Even if the current price is too low, it doesn't mean it will recover tomorrow. (It may take many years)

- Just doing the opposite is not enough, you also need more information to support your behavior.

Be careful and skilled at catching the falling knife.

### Chapter 12 Finding Cheap Targets

- Set a "feasible investment scope"

- Find the reward-to-risk ratio:

- Find out whether the price is at a high or low level

- Expected return

- Generate conditions:

- Fundamentals are in doubt

- Controversial

- Poor past returns

- Targets that have been reduced recently

- In the process of selecting cheap targets, you must use second-level thinking. Repeatedly think and confirm whether there are hidden doubts in it.

### Chapter 13 Patience in Waiting for Opportunities

- Be patient in waiting for opportunities to come, rather than desperately searching in the market.

- The subprime mortgage crisis of 2007 ~ 2008, it wasn't until 2009 that there was a chance for a turnaround. The Great Depression took 30 years to recover, and so did the Great Depression in Japan.

- Before investing, you need to confirm whether the current environment is a low-return environment or a high-return environment.

- The returns generated by buying assets that are forced to be sold will be the highest. So, immediately bottom-fishing when a storm occurs is not the correct strategy. You have to wait for someone to be forced to withdraw before entering the market.

### Chapter 14 Recognizing the Limitations of Prediction

- No one can predict "long-term" and "accurately"

- Admit your limited knowledge and take related actions. (Constantly review the risks and reduce the risks as much as possible).

### Chapter 15 Perceiving the Economic Position

- Always be vigilant about the market

- Understand what is happening

- Measure market heat

- Change strategies according to the environment

- Market Heat Assessment Guide

### Chapter 16 Recognizing the Role of Luck

#### The Key to Profit:

- Proactive, timing and skills

- People who are proactive enough at the right time don't need too many skills. (Often it's just luck)

Few geniuses can succeed continuously two or three times.

You must have defensive investments to counter unknown economic stages.

### Chapter 17 Adopting a Defensive Investment Strategy

Investment is not a winner's game. Continuously adopting high-risk, high-return investment methods cannot last long.

Through the mindset of a loser's game, constantly reducing risk and reducing mistakes can lead to long-term investment.

The winner's strategy is correct in the short term and in a bull market, but it is difficult for investors to accurately grasp the current economic situation. Therefore, in the long-term investment, you must use a defensive strategy to reduce your mistakes and reduce risks.

#### Defensive Investment Strategy

- Eliminate poorly performing investment targets. (Requires in-depth evaluation and purchase at a low price, setting a larger margin for error)

- Avoid market downturns

- Diversify investment targets

- Worry about the possibility of losses

- Be afraid of investing (don't be overly greedy and blind, and seriously review)

#### Margin of Safety / Margin for Error

- When investing in a target, use the lowest price to invest. (Reduce the effect of losses)

While avoiding losses, profits will also come.

### Chapter 18 Avoiding Investment Traps

As long as you can avoid making big mistakes, investors need to do very few things right.

- Warren Buffett

Various investment traps are as follows:

- **Lack of imagination**: Unable to imagine the related impacts and inclusions, making risk assessment unable to be comprehensive and thorough.

- **Insufficient psychological quality**: Following greed to buy, but selling in a panic because of fear.

### Chapter 19 Adding Value

#### Two Values: (Alpha \(α\) and Beta \(β\))

- **Alpha**: Individual investment skills, the ability to create performance excluding market fluctuations.

- **Beta**: The sensitivity of the investment portfolio to the market.

y = alpha + beta X

y: Return

X: Market fluctuation

This can show some key points:

- Under the acceptable risk and volatility, through a high beta, high volatility investment portfolio, there will be good returns.

- The impact of alpha is relatively small, especially under market fluctuations. The focus is still on the volatility (beta) of the investment portfolio.

- In a bear market, you must adjust your investment portfolio to be less affected. Otherwise, it will be difficult to adjust profits no matter how high your skills are.

### Chapter 20 Reasonable Expectations

#### High Return Conditions (Relatively Abnormal)

- Buy when extremely bearish

- Bear a large amount of risk

- Have special investment skills

- Good luck, good luck, good luck

Therefore, investors should only pursue stable and reasonable returns (as reasonable expectations)

I need an 8% return, and I'm happy to earn 10%. But I won't have to bear higher risks because I earn more.

### Chapter 21 Doing All the Important Things Well

- Understand the value of the target: operating potential, development, the ability to generate cash.

- You must learn second-level thinking and see what everyone hasn't noticed. (Or have more patience)

- The view of "value" must be meticulous and disciplined, so that you won't sell easily when it rises, and you can add more when it falls.

- After understanding the value, you need to know that you must buy it at a price lower than the value to profit. (Reduce risk)

- Many people underestimate the current situation, so they often misjudge the value.

- The only way to increase returns is: buy low-risk assets at a lower price.

- Value is affected by psychological and technical aspects, you must be firm in your judgment of value. (Of course, you have to constantly review to make sure you're not mistaken)

- The investor's mentality is like a pendulum, but the middle is often the longest. Don't expect a turnaround as soon as you see a crash.

- Understand that greed and fear often control the public's psychology. You must understand it and stick to your own ideas.

- You will never know when a bull market will turn into a bear market, always maintain a cautious mentality.

- Reject the "ways that you must bear more risk to profit"

- Under the same return conditions, every investor must hold on to reducing the current risk. (Make the purchase price lower)

- Margin for error:

- Only buy at a low price

- Abstain from leverage

- Diversify investments

- It is impossible to know and accurately predict the future. You can only grasp the situations you care about and do the relevant homework to the best of your ability.

## Thoughts:

In order to write this chapter summary, I seriously read every page and every chapter again. I am very impressed with the arrangement of the whole book. When learning about US stocks, I often see some targets that others talk about and jump in to look at them, and I bought some right away. Looking back, I found that several investment portfolios were all in the same group. When a crash occurred, it was also a heavy killing, and no matter how I stopped the loss, I couldn't stop the bleeding.

After reading this book, I have a new understanding of the crash of inflation and interest rate hikes, and I am not afraid on a psychological level. The overall operating method has also changed from the previous method of buying at market prices to limit price buying. I strictly adjust my impact on market fluctuations, and I can also sleep peacefully. Any fluctuations also have related changes. The related operational changes are adjusted as follows:

- No longer staring at the US stock market

- Purchases are definitely not through market prices, but pre-set limit prices

- The setting of limit prices is based on the degree of decline, and try to buy in a pyramid. Avoid top-heavy. (Of course, because I'm a newbie, the units are all 1 ~ 2)

- Continuously track the financial reports in hand to confirm that the company's cash flow is sufficient.

- The general direction is adjusted to defensive investment: KO, PG, VOO, VIG

- Others are value stocks: AAPL, MSFT, NFLX

- US stocks and Taiwan stocks are really different. 80% of my assets are still in the high dividend stocks of the Taiwan stock market. Be sure to focus on conservative profits.

The growth stocks of US stocks are really too volatile, no matter which targets you choose. It's also possible to directly continue to fall to 50%. Strict stop-loss settings are also a must. These situations are all because the value assessment of growth stocks is too optimistic.

Finally, I also recommend it to everyone who invests in US stocks, and I hope everyone can have a stronger psychological construction to face every change ㄡ

Top comments (0)