title: [Book Sharing] Grey Thinking

published: false

date: 2021-12-11 00:00:00 UTC

tags:

canonical_url: http://www.evanlin.com/grey-thinking/

---

[](http://moo.im/a/8wCIMP "Grey Thinking")

Author: Hsieh Meng-Kung Publisher: Global Views Publishing

Published: 2021/04/20

Language: Traditional Chinese

eISBN: 9789865251208

ISBN: 9789865251024

- Book purchase recommendation website:

- E-book: [Readmoo](http://moo.im/a/8wCIMP)

# Preface:

This is the fifteenth book I've read this year. The reason I bought this book to read is, of course, because it's written by [Hsieh Meng-Kung, the author of the well-known Podcast "Gooaye"](https://podcasts.apple.com/tw/podcast/gooaye-%E8%82%A1%E7%99%8C/id1500839292). "Gooaye" is a very popular Taiwanese Podcast recently, mainly focusing on the analysis of listed companies and introducing some core strategies for stock selection. It's a very practical and interesting Podcast. And since this book is the author's work, I naturally wanted to take a look. I highly recommend everyone to read it together; it explains a lot of core strategies. I believe it will be of great help in investing in the stock market, and even in investing in life.

# Content Summary and Thoughts:

Between zero and one, there are infinite numbers.

Between black and white, there are also infinite shades of gray.

Facing the ever-changing market, break free from black-and-white thinking,

Only then can you see infinite value!

The poor want to gamble and turn their lives around; the rich want to preserve their capital and grow. Without the ability to judge, you might win a few times, but you can't resist the temptation, and eventually, what you win by luck will be lost by skill. And incorrect cognition is like an incorrect flight instrument panel; even if the aircraft's performance is excellent, it may still lead you astray from your goal, or even crash into the vast ocean. Investing and financial management are not difficult, only the ability to judge and overcome human nature. Constant reading, thinking, and backtesting is a form of training your judgment, allowing our brains to have a new operating system. And investing and financial management, like life, have no absolute black-and-white answers; the best answers often exist in a band of gray shades.

The market is a place where anyone can easily join and lose their life savings. Don't rush to fight to the death in a few days. Crouch down first to jump higher, but don't crouch until your legs are numb and you can't jump at all; practical experience in the market is the key. But when facing the market, you must:

Be optimistic, but not naive;

Be patient, want to double, but don't flip the car;

Take action, and be willing to take risks!

# Chapter Outline

## Part 1 - Mine Sweeping: Removing Common Sense that Obstructs Thinking

Every system has its "bug," and the first important thing to do when entering the stock market is to eliminate the problematic aspects of your personality (regarding investment). Avoid affecting your profits.

The three major factors of investment and one hidden bonus: "Principal, rate of return, time, plus being born into the right family."

Besides being born into the right family, the amount of principal is also important. At this time, the profits from your main business are still very important. Accumulating basic capital can also be done through diversified investment methods to allow yourself to experience the market, and also to enter the capital market as soon as possible.

The market changes are variable, with 7% of companies contributing more than 70 times the growth. Therefore, selecting companies is much more important than any buy-and-sell strategy. And because it's difficult to select the 7%, it's very important not to put all your eggs in one basket.

Regarding worshiping gods, it's a way to let yourself go and relax. Faced with uncertainty and doubt, humans mostly worship gods. This is not the case for stocks; you need to prepare through a lot of data. Reduce your chances of danger to the lowest possible level. And strictly adhere to discipline; it's better to earn less than to lose money.

- Establish the correct financial management concept and strengthen your ability to interpret information

- Plan strategies and implement them with discipline

Newcomers should start with the overall market, and the sooner the better. Only then can you feel the fluctuations of the stock market.

Robert De Niro: "The odds in a casino are basically calculated. The manager's task is to keep you in the game. You might win a few times, but you can't resist the temptation. Eventually, what you win by luck will be lost by skill."

## Part 2 - Preparing Provisions: Building a Judgment Operating System

Before going to war, you need to be fully prepared, and so it is when entering the investment market.

- Don't put all your eggs in one basket (I remember it can be 70% active, 30% passive)

- Absorb good, unprocessed knowledge, and avoid personal bias after the knowledge has been processed. (You can listen to 13F reports)

- Editor's note: SEC Form 13F: The U.S. Securities and Exchange Commission (SEC) requires investment institutions with assets under management exceeding 100 million [USD](https://invest.cnyes.com/forex/detail/usdtwd) to submit their holdings of U.S. equities and related fund flows to the SEC within 45 days after the end of each quarter (three months).

- Never listen to the 3Fs (Friends, Family, Fools)

- Usually, winners have good reading habits, and optimism is built on "sufficient preparation, foresight, enthusiasm, motivation, and gradual growth."

- The second characteristic of winners is "patience."

- Maintain doubt about any information and verify it (inquire).

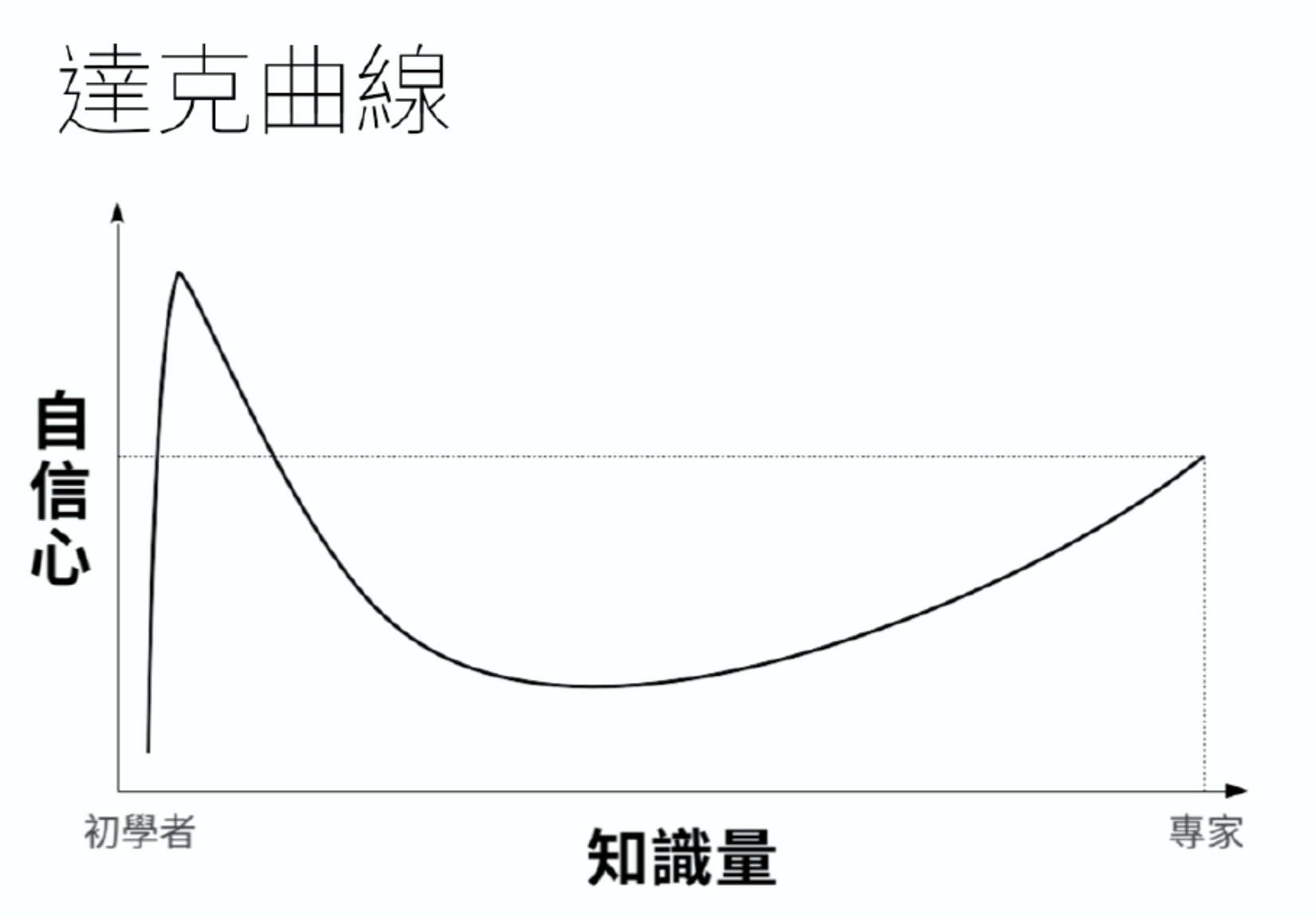

For your own knowledge, you must maintain doubt and verify it to avoid falling into the Dunning-Kruger effect, creating a misconception.

## Part 3 - Going into Battle: Facing the Ever-Changing Market

Speaking of investment techniques and core strategies, the author cites Bruce Lee's "Be Water, My Friend" approach. It's also like what the author of this book often mentions in the Podcast: "There are absolutely no techniques in investment that will definitely win; otherwise, just leave it all to the computer, which is strict and will never make mistakes."

So having flexible adaptability and strictly adhering to relevant discipline is the most important thing for investors.

- First, recognize who you are and your tolerance for assets. How to sleep well.

- Review your account statements every half year, don't be too short-term.

- Choose stocks with a future (companies with dreams)

Warren Buffett's famous saying: "If you're not willing to hold a stock for ten years, don't even think about holding it for ten minutes."

- For major stock market fluctuations, first remove all your leverage. Only hold spot positions and observe the market changes.

- When masters encounter a big drop, handle it elegantly and with strict discipline.

- Choose the best companies, just like choosing the most beautiful goddess.

- VIX (Volatility Index) often correlates with the S&P 500, so you can enter the market at the right time.

- Newcomers should not drive big cars; no matter how hard you work, it's just the basics. Never put yourself in a state where you're likely to graduate.

- Before speculating in stocks, first manage your life well.

# Thoughts:

Recently, because I've been seriously looking at stocks, I often absorb information from "Gooaye" in these few issues. Perhaps it's like what the author says; many listeners often don't necessarily play stocks, and often listen for their health. Because besides being filled with a lot of colloquial language, which often makes people smile. You will find that many investment concepts often may also greatly improve your life.

- Prepare good information

- Do not over-invest, don't put all your eggs in one basket

- When encountering major fluctuations, be calm and strictly adhere to discipline

Even in life, it seems to be an unchanging truth, right!

# Related Links:

- [Gooaye Podcast - Apple Podcast](https://podcasts.apple.com/tw/podcast/gooaye-%E8%82%A1%E7%99%8C/id1500839292)

- [SEC Form 13F](https://www.sec.gov/divisions/investment/13ffaq.htm)

- [SEC 13F Filings](https://13f.info/)

Top comments (0)