uniswap-v2.md

https://youtu.be/t0NZq8SmywU

contract overview

Factory

pair

add remove liquidity and swap tokens

router

is an intermediate contract between the user and the pair contracts the main job of the router contract is to safely add remove liquidity from the pair contracts and also safely swap tokens with the pair contracts.

the router contract is a useful contract if we have to do multiple hop swaps

Code repos:

v2-core

v2-periphery

swap

swapExactTokensForTokens() -> getAmountsOut()

swapTokensForExactTokens() -> getAmountsIn()

How to directly call the swap in pair contract:

//@ztmy before directly call the pair contract instead of calling the router contract:

// 1. transfer token to pair

// 2. excute UniswapV2Library.getAmountsOut to calculate the amount0Out, amount1Out

uint256 amountOut = params.isZeroForOne

? getAmountOut(params.amountOut, reserve1, reserve0)

: getAmountOut(params.amountOut, reserve0, reserve1);

// transfer eth borrow form loan swap to pair1

IERC20(tokenOut).transfer(params.pair1, params.amountOut);

// git DAI form pair1

IUniswapV2Pair(params.pair1).swap({

amount0Out: params.isZeroForOne ? amountOut : 0, // 10682631633961643998417

amount1Out: params.isZeroForOne ? 0 : amountOut, // 0

to: address(this),

data: ""

});

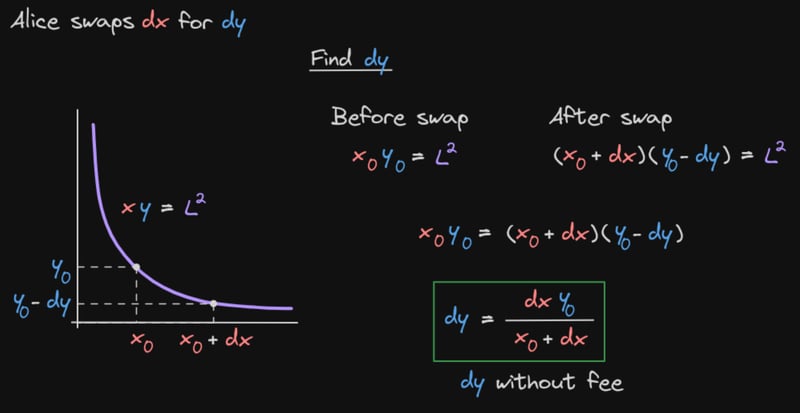

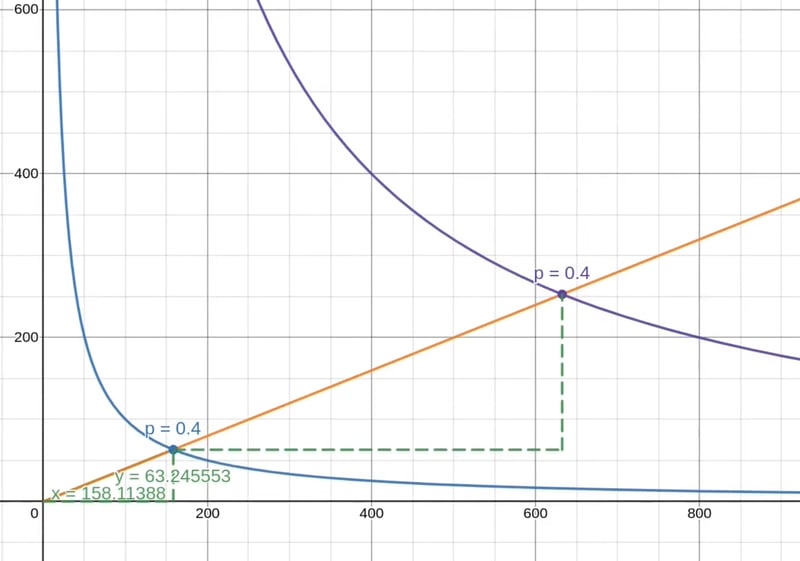

spot price (mid price) = current price = X0 / Y0

execution price:

Cause of slippage: Market movement

createPair

1 byte=8 bits=2 hex characters

Ethereum address length = 20 bytes = 40 hexadecimal characters = a large decimal integer of more than 48 bits

to make sure that the UniswapV2Pair contract is only dependent on token0, token1 that it can be calculated from token0 and token1, for the UniswapV2Pair contract Constructor argument it passes nothing, it will call a function called initialize to set token0, token1.

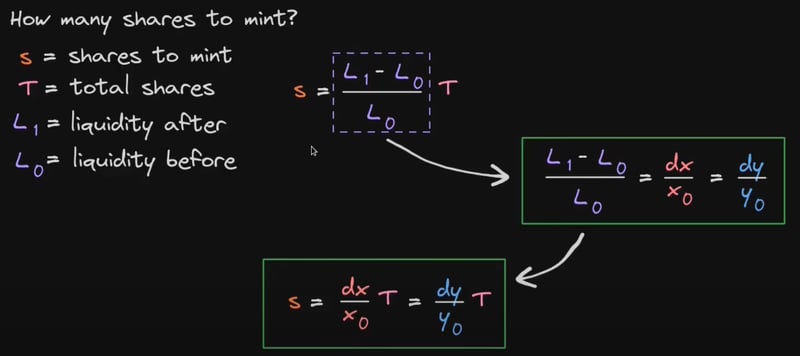

add liquidity

the amount of tokens inside this AMM is described by this point.

when we're adding liquidity is that the resulting amount of token X and token y most must be along this line.

three way to define the pool value:

get pool shares after add liquidity:

Flash swap (Flash loan)

Flash swap fee derives from swap fee.

// Uniswap V2 callback

if (data.length > 0) IUniswapV2Callee(to).uniswapV2Call(msg.sender, amount0Out, amount1Out, data);

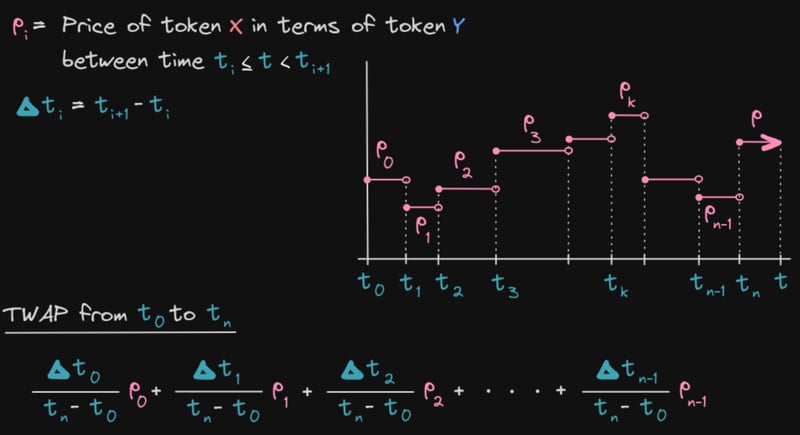

the danger of amm's spot price as a price oricle was Spot price manipulation.

TWAP-(time weighted average price)

Cumulative price

using cumulative price to calculate the TWAP

uint256(uint224(y) * 2**112 / uint224(x)) = (y / x) * 2^112

Fixed-Point Number is a method of representing decimal numbers using integers.used to simulate decimal arithmetic in systems (such as Solidity) that do not support floating-point arithmetic.

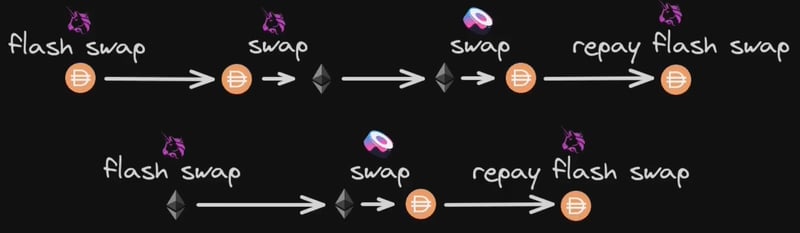

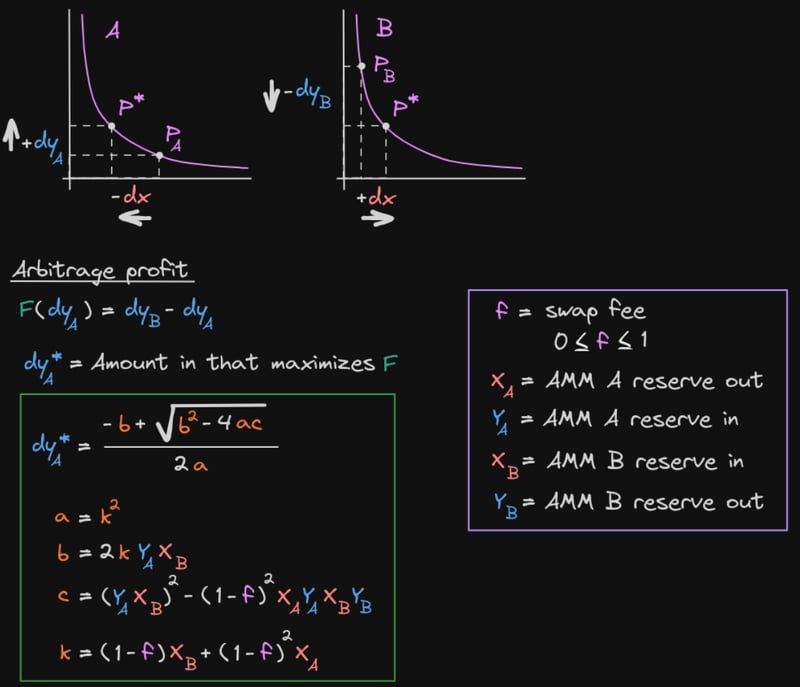

Arbitrage

UniswapV2Arb1

- execute Arbitrage between three UniswapV2Pair contracts

- model_1 in uniswap_v2_arb.png(borrow DAI and return DAI)

- The swap fee is calculated at the end.

- in this exercise we'll calling the router contract(swapExactTokensForTokens)

UniswapV2Arb2

- execute Arbitrage between two UniswapV2Pair contracts

- model_1 in uniswap_v2_arb.png(borrow ETH and return DAI)

- The swap fee calculation is included in the borrowing process(getAmountOut).

- in this exercise we'll need to directly call the pair contract instead of calling the router contract.

Top comments (0)