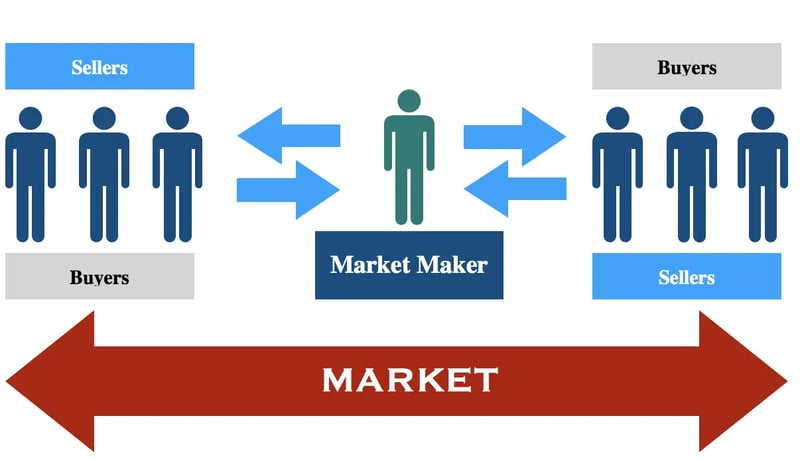

Market making is a key strategy in crypto trading that helps maintain liquidity on exchanges by placing both buy and sell orders. This ensures tighter bid-ask spreads, leading to faster trades and better pricing for all traders. In return, market makers get fee discounts,

rebates, and other incentives, making it a profitable approach.

🔑 Why Choosing the Right Strategy Matters

To succeed as a market maker, you need to:

✔️ Pick the right exchange with competitive incentives.

✔️ Use algorithmic trading to optimize order placement.

✔️ Manage risks effectively through sub-accounts and hedging.

✔️ Monitor market conditions to adjust your strategy.

🔍 Best Market Making Programs

Based on research, here are top exchanges offering the best conditions for market makers:

🔹 Bybit – Offers rebates up to 0.005%, exclusive fee discounts, and institutional loans with competitive rates. Best for Asia-based traders and retailers. 💎

🔹 WhiteBIT – Provides rebates up to -0.010%, margin trading within the spot market, colocation services for optimized speed, and a flexible API. It’s Europe’s largest exchange by traffic. 🚀

🔹 Bitget – Features maker fees as low as -0.012%, monthly subsidies, low entry barriers, and dedicated support. A strong choice for institutional traders and retailers in Asia. 🔥

📌 How to Get Started

1️⃣ Choose an Exchange – Pick a platform with the best market-making incentives.

2️⃣ Apply for a Program – Meet the trading volume requirements and submit an application.

3️⃣ Develop a Strategy – Use bots and algorithmic trading for efficient liquidity provision.

4️⃣ Earn Rewards – Get rebates, fee discounts, and exclusive bonuses.

Market making is one of the most profitable strategies for active traders, offering lower fees and extra earnings. If done right, it can significantly boost your trading profits! 📈💹

Which exchange do you prefer?

Top comments (0)