Hey, my name is Santhosh Nimmala, and I work as a Principal Consultant at Luxoft, leading Cloud and DevOps in the TRM space. In this series of articles, I will be discussing about various solutions for FSI usecases, including real-world projects with code examples and common Arch patterns. In this article, we will delve into the Grid implemetation using AWS(options pricing usecase) in capital markets.

What is Financial services and Capital markets ?

Financial services include banking, investing, insurance, and financial planning, among other diversified services. They provide crucial instruments for managing money, building wealth, and defending against unforeseen financial difficulties. They cater to the interests of both individuals and companies.

On the other hand, capital markets are vibrant centres where businesses, governments, and investors interact. Organisations can raise cash by issuing stocks and bonds on the primary market, and the secondary market makes it possible to trade these securities. Markets for equity and debt provide channels for investment, and markets for derivatives permit risk management and speculation.

Why we need Grid ?

in capital markets usually , banks trade on options and it need to be priced daily , it uses an application that performs the calculations on the marlket data through financial quantitative analysis . if use use normal approach it may take few days to price the bank's entire portfolio of options , but if i want to run entire portfolio of options in one hours ? that where cloud comes to picture it can provide unlimited compute power with less cost compared to on-premises .

Using several networked computers(Grid) in a grid configuration, grid computing is a high-performance computing strategy that can handle challenging jobs. Through the use of a grid of linked machines, it allows businesses to process large amounts of data and calculations in an efficient manner.

How to implement Grid in AWS ?

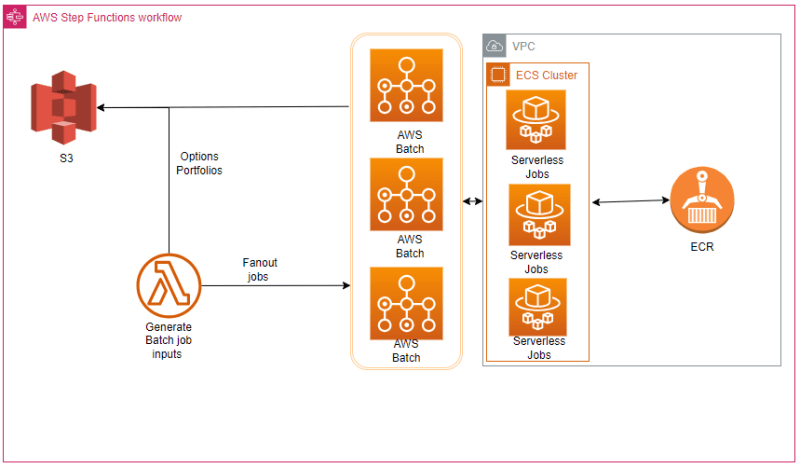

we can create a workflow orchestration to perform financial quantitative analysis by using below aws service .

- AWS Step Functions

- AWS Batch

- Amazon ECR

- AWS ECS

- AWS Fargate

- S3

- Lambda

in this solution we can use a grid computing architecture with AWS Batch to process an entire portfolio of options data .

AWS batch is a fully managed service that helps to run batch computing workloads at any scale , that means AWS batch can automatically provisions compute resources and optimizes workload distribition based on the quantity and scale of workload .

AWS step functions workflow orchestration acts as a an orchestrator and is configured with an AWS lambda function , AWS batch job queue and job definition parameters .

Lambda function takes an input file(JSON) form S3 bucket this file is nothing but large file with Trades and portfolio details , lambda will split this big file to multiple smaller files .

AWS step Function workflow then creates a batch job for each of the splitted JSON file , the batch jobs are configured to use AWS fargate serverless compute capacity to process the portfolio options for each of the JSON files

computing application for processing these files can be containerize using docker and store this image in ECR (Elastic container registry ) used by ECS

The adoption of cutting-edge technologies has become crucial in the fast-paced world of capital markets, where seconds may make or break fortunes. Enter grid computing, a paradigm-shifting technology that, when combined with AWS Batch, Lambda, and Fargate, offers a range of benefits that enable financial institutions to compete in a landscape that is becoming more and more competitive.

Scalability and speed: The scalability of AWS Batch, Lambda, and Fargate is unsurpassed. The ability to scale up resources on-demand allows lightning-fast execution whether managing large datasets or carrying out intricate financial modelling. This flexibility is essential for making split-second trading decisions and performing in-the-moment market trend analysis.

Cost effectiveness: Grid computing using these AWS services reduces expenses by cutting down on unused resources. You just pay for the computer power that you really utilise, thus there is no need for expensive infrastructure.

Managed Services : AWS's managed services, including as AWS Batch, AWS ParallelCluster, and AWS HPC, make it easier to set up and run Grid setups, which lowers operational costs.

Security and Compliance: Security and compliance: To assist you in meeting security and compliance needs, AWS offers strong security features including encryption, IAM (Identity and Access Management), and VPC (Virtual Private Cloud) setups.

In conclusion, the integration of grid computing with AWS Batch, Lambda, and Fargate ushers in a new age for capital markets. It provides scalability, cost-effectiveness, dependability, security, and a competitive advantage that positions organisations as innovators. These technologies, which are strategic assets rather than merely tools as the financial landscape changes, enable financial professionals to traverse the market's complexity with confidence & agility, which ultimately encourages success and growth in the always changing financial arena

Top comments (0)