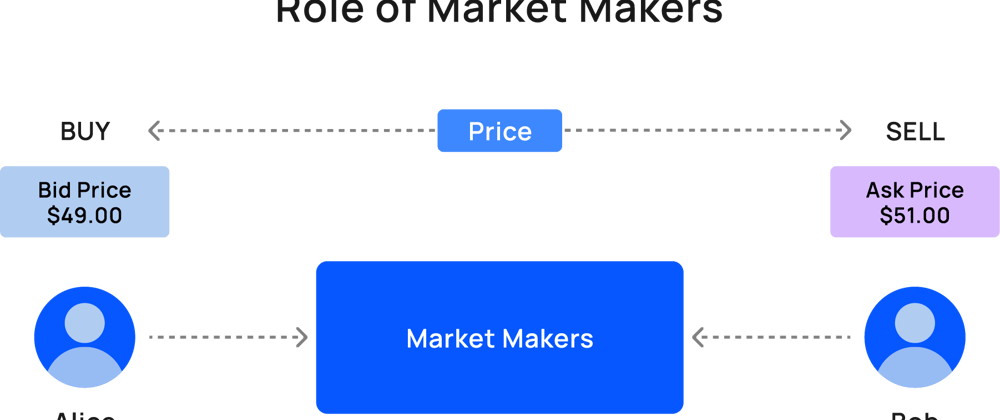

Market making is one of the most profitable and impactful trading strategies in crypto. By placing both buy and sell orders, market makers keep the market liquid, reducing spreads and improving execution for all traders. In return, they receive rebates, fee discounts, and exclusive perks, making it an essential strategy for professional traders.

🔥 Why Market Making is Crucial

✅ Ensures liquidity – Faster trades and reduced volatility.

✅ Lowers trading costs – Fee rebates and discounts increase profitability.

✅ Boosts institutional trading – Market makers help stabilize prices and attract volume.

✅ Algorithmic trading advantage – AI-powered bots optimize order execution.

💡 Steps to Start Market Making

1️⃣ Select an Exchange – Pick the best platform based on fees and incentives.

2️⃣ Apply for a Program – Meet the volume requirements and apply.

3️⃣ Develop a Trading Strategy – Use algorithmic trading bots for efficiency.

4️⃣ Optimize & Scale – Monitor market trends and adjust your approach.

🔎 Best Market Making Programs Right Now

Choosing the right exchange is key. Here are some of the best platforms for market makers:

🔹 WhiteBIT – Leading European exchange with rebates up to -0.010%, colocation services for faster execution, and a flexible API for advanced trading strategies. Best for pro traders and institutions. ⚡

🔹 Bybit – Up to 0.005% rebates, low fees on both Spot and Derivatives, and access to institutional loans for traders needing additional capital. A strong choice for Asia-based traders. 🌏

🔹 Bitget – Offers market makers fees as low as -0.012%, monthly subsidies, and a dedicated support team. Great for traders looking for low entry barriers and long-term rewards. 🚀

Market making is not just about earning rebates—it’s about controlling liquidity, reducing trading risks, and maximizing profits. If done right, it can provide long-term sustainability in crypto trading. 📈

Top comments (0)