The Idea Of Writing This Story Came To Me After Watching Darren Aronofsky's Movie Pi(1998) It Got Me Hooked To the Idea That There is a Secret Formula Of Succes In Stock Market But Needless To Say There Isn’t A Formula Like That. But Quantitative Analytics Comes Pretty Close To It. So In This Post, I’ll Give You An Introduction About Quantitative Analysis.

What Is Quantitative Analysis?

To Understand What Quantitative Analysis Is You First Have To Understand What Does Stock Mean? And What It Means When Someone Says That They Own A Particular Stock?

A Stock Is Nothing But A Piece Of Paper Which States That You Own A Certain Part Of A Company. When You Buy A Stock You Own That Stock But In Return You Have To Give Money To That Particular Company This Is How A Company Raises Capital Or Money To Keep Their Operations Going and Keep Innovating.

In The Simplest Way, I Can Put This Is Being A Quantitative Analyst Means that You Analyze a Bunch Of Financial Data By Using Scientific Methods So That You Can Pick Out The Best Stock. So In Quantitative Analysis, We Study a Bunch Of Financial Data In Order To Pick Out The Best Stock And Predict The Future Of Stocks.

What Does A Quantitative Analyst Do?

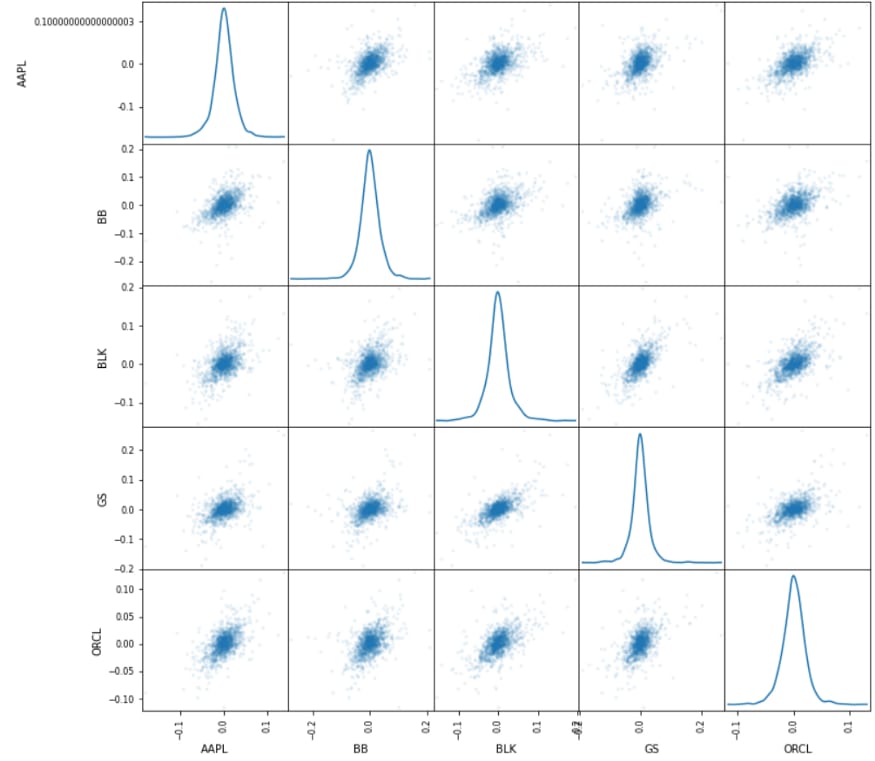

A Quantitative Analyst Analyze The Statistical Data About The Concerned Stocks Most Of The Time By Using Certain Programming Languages Like Python, C++, Or R The Analysts Use Statistical Models Like Linear Regression And Use Methods Like Ordinary Least Squares. I’ll Show You Some Of the Analysis. Below You, Will See The Code And The Output Of that Code Which Gives Us The Scatter Matix Of Certain Stocks With Kernel Density Estimate In Diagonal. Don’t Worry About The Results I’ll Explain It In The Next Post.

pd.plotting.scatter_matrix(daily_pct_change,diagonal='kde',figsize=(15,15),alpha=0.1)

plt.show()

Here’s What An Ordinary Least Square Regression Results Looks Like.

AAPL_returns=daily_log_returns.iloc[:,0]

GS_returns=daily_log_returns.iloc[:,3]

return_data=pd.concat([AAPL_returns,GS_returns],axis=1)[1:]

X = sm.add_constant(return_data['AAPL'])

model = sm.OLS(return_data['GS'],X).fit()

print(model.summary())

As You Can See The OLS Gives Us Some Very Important Metrics Which We Can Use To Develop A Trading Strategy.

What Is A Trading Strategy?

In Simple Words Trading Strategy Is A Fixed Plan About How You Approach Stocks Like Short Selling Or Going For A Long Haul There Are Lots Of Trading Strategy Available Some Of Them Are Given Below.

1.Moving Average Crossover

2.Dual Moving Average Crossover

3.Turtle Trading

4.Mean Reversion Strategy

And Many More…..

We’ll Talk About Each Trading Strategy In The Next Post.

How To Get Started In Quantitative Analysis

To Get Started In Quantitative Analysis You Should Know A Little Bit About Statistics And Computer Science And You Should Know at least One Programming Language Like Python, C++, etc. In the Case Of Python, You Should Also Know About Various Libraries Like Pandas, Numpy, Matplotlib, etc. In The Case Of C++, There Is C++ Boost Library, ML pack C++ Library These Libraries Are Necessary If You Want To Learn More About Quantitative Analysis.

I Would Like To Thanks Datacamp For Their Courses.

I hope you found this Post On Quantitative Analysis useful!

If you have any suggestions then please let me know.

Follow Me On:

Github:DataCrusade1999

Instagram:Ashutosh Pandey

Top comments (0)