Accelerating Insurance Innovation with Faster Software Development

The insurance industry has always been cautious, but today it faces big changes.

Customers now expect faster, more personalized services, and competition from innovative startups is increasing. Insurers need to adapt quickly and find new ways to deliver products and services more efficiently.

In 2025 innovation in insurance isn't just about creating better products. It's also about changing how those products are built, updated, and delivered.

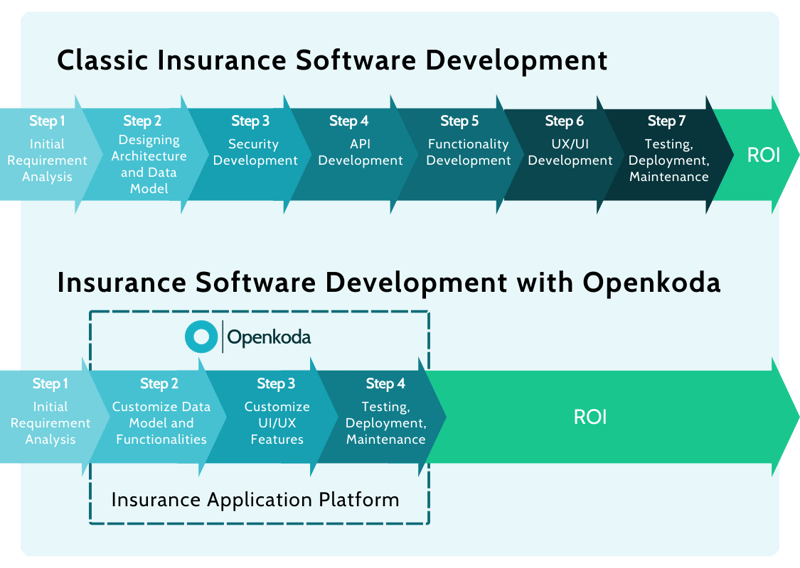

After all, what's the point of launching a new, innovative insurance product if a lengthy and resource-consuming development process eats into the ROI—only to discover that two competitors have already launched similar services?

Being able to launch new insurance products quickly, adapt existing offerings easily, and streamline complex workflows is now essential.

Insurance companies that can’t move fast enough risk falling behind.

Insurtech development and low-code platforms have become key tools for insurers looking to speed up their digital transformation.

These platforms simplify app development with easy-to-use visual interfaces, drag-and-drop features, and pre-built templates specifically made for insurance tasks. This means business and tech teams can build solutions faster, without needing deep technical expertise.

For insurers, low-code brings clear advantages.

They can launch new apps quicker, respond faster to market changes, personalize their services easily, and make better use of their existing resources.

By adopting low-code platforms, insurance companies not only handle today’s challenges more effectively, but also set themselves up for future growth and innovation.

Top 5 Insurance Low Code Platforms in 2025

Openkoda

Openkoda is an innovative low-code development platform knowns for its robust capabilities in rapidly building insurance applications.

It significantly speeds up software development while minimizing vendor lock-in thanks to its tech stack being based on open and popular technologies like Java.

It offers templates for various applications, such as Embedded Insurance, Claim Management, Policy Management, Property Management, which can be customized to meet specific business needs.

Openkoda also offers an open-source version, allowing companies to deploy the platform on-premises if needed.

Headquartered in Wrocław, Poland, the Openkoda team additionally provides custom insurance application development services, ensuring tailored solutions for unique business needs, at a fraction of the cost of building a system using traditional processes.

Key features specifically beneficial for insurance

- Insurance ready data model and application templates

- Easily extendable with custom modules and adaptable to different business domains.

- Role-based access control (RBAC), secure API management, and support for encrypted secrets.

- Embedded insurance capabilities

- REST API support, webhook handling, and third-party system integrations.

- Full-text search and advanced filtering capabilities across entities.

- Support for importing and exporting data for ease of migration and backups.

- Customizable claim management systems

- AI-powered decision support and Reporting AI

Unique selling points

- High customizability without vendor lock-in

- Standard programming language support

- Significant reduction in development time

For who

- Insurance enterprises

- Insurtech startups

- Companies struggling with legacy insurance software

- Companies seeking highly customizable insurance solutions

Mendix

Mendix is a low-code platform known for improving the efficiency of insurance software development processes.

Its strength lies in its ability to smoothly integrate with existing legacy insurance systems.

Mendix simplifies the complexities of insurance processes, allowing companies to accelerate underwriting and policy management tasks.

Key features specifically beneficial for insurance

- Accelerated underwriting processes

- Integration with legacy insurance systems

- Advanced analytics for risk assessment and fraud detection

- Scalability through cloud-native architecture

Unique selling points

- Strong community support and reusable components

- Ease of integration with existing systems

For who

- Mid to large-sized insurance firms

- Companies with complex legacy system integration needs

OutSystems

OutSystems is a highly user-friendly low-code platform headquartered in Boston, Massachusetts.

It excels at providing intuitive interfaces and tools that enable even non-technical users to build robust applications easily.

With a strong focus on user experience, OutSystems is ideal for insurance companies looking to quickly scale their solutions without sacrificing quality or usability.

Key features specifically beneficial for insurance

- Enhanced user experience through pre-built templates

- Automation of policy administration and claims processing

- Seamless mobile application development

- Integration capabilities via APIs and connectors

Unique selling points

- Extensive pre-built templates and workflows

- Rapid scalability and ease of use

For who

- Fast-growing insurance companies

- Companies emphasizing user experience

Appian

Appian offers a robust low-code platform specializing in workflow automation and real-time data analytics.

It is especially suited for complex insurance operations requiring precision, speed, and reliable data insights. Appian streamlines business processes, reduces manual work, and enables faster decision-making.

Key features specifically beneficial for insurance

- Robust workflow automation

- Real-time data analytics and predictive modeling

- Compliance and audit-ready capabilities

- Secure, role-based data management

Unique selling points

- High performance in workflow automation

- Strong analytical capabilities

- Enterprise-level security and compliance

For who

- Large insurers handling complex processes

- Insurance companies prioritizing operational efficiency

Pega

Pega is a **versatile low-code platform highly valued by insurers aiming for exceptional customer relationship management **and intelligent automation.

Its platform provides advanced tools for automating customer interactions and improving overall client experience.

Pega is well-suited for companies wanting comprehensive, intelligent automation solutions.

Key features specifically beneficial for insurance

- Strong capabilities in customer relationship management

- Integration of intelligent automation

- Predictive analytics and decision-making tools

Unique selling points

- Advanced CRM and customer interaction tools

- Comprehensive intelligent automation features

For who

- Insurers focused on customer experience

- Companies needing robust automation and integration

Top comments (1)

If you want to see how your organization's software development can be speed up with the right tools, book your own personalized live demo in the link below:

Book a demo