Expanding into a new market is always a risk, especially if your niche in this market is already a red ocean and the market itself is very different from those you’ve already mastered.

The Chinese market has always been a tough nut to crack for Western and European companies. The probability of bringing a successful EdTech company here is very small since this market in China is already occupied by local players.

In addition, there are a lot of nuances in China that are not obvious to Western marketers. We have always loved to take on challenges, so we started trying to expand to a wide variety of markets including the Chinese. In this article, I’ll share with you how we did it.

New markets. First (failed!) try

Due to the success of and interest in CodeGym in the Western Europe market, it was logical to expand our local online product to other countries. However, our first attempts were unsuccessful. In 2014, we were interested in the Indian market. Since India is a country where IT outsourcing is developed, the potential audience is very large, and the salaries of software developers are significantly higher than the national average, which makes them kind of rock stars. It’s also important to note that, in India, most people can speak and understand English.

We didn’t do marketing research; instead, we decided to try an inside approach: we left for India for six months with our entire small office. It turned out to be a really smart decision, though we faced difficulties very quickly. As of 2014, India had mostly mobile internet, but it was slow and of poor quality. Only 15 of 250 million Internet users had a decent internet connection. In addition, it turned out that online payment systems were in their infancy in India, making payment difficult. As a result, we saw interest in our course, but much less than we expected. Unfortunately, there were no sales at all.

We retreated and began research, learned the US market, and launched contextual advertising. There was interest in the course, but we, unfortunately, did not take into account some local peculiarities, making the English translation of the course subpar.

New markets. Next steps

Although the first attempts were unsuccessful, we drew valuable conclusions from them and built a circuit that worked as a result. To begin with, we used an approach based on testing risk assumptions. The main idea was to get user feedback as quickly as possible and test the idea even before creating the product.

Using this approach, we checked the markets we were planning to enter, and realized that they were growing. We hired a localization team and prepared the first local English language CodeGym. After that, we ran tests to ensure our product fits into the market. We have highlighted several important metrics associated with learning(passing the beginning of the course, solving the first problems) and the convenience of registering on the website. After a while, we sent out a questionnaire to clients in which we asked how disappointed they would be if they could no longer use CodeGym. There is a generally accepted estimate for this question: if 40% or more are disappointed, then there is product-market fit. Our estimate was 63%.

The next step was to search for different distribution channels; PPC, PR, SEO specialists appeared and we found channels that work for us. Ultimately, we received a lot of positive feedback about the course from non-English-speaking countries, so we thought it would be nice to launch a localized CodeGym in these markets.

At the moment, we’ve developed a system of “accelerated testing” of the market, where, with minimal effort, we’ve been able to check whether a new market is suitable for us in one to two months.

The following are the most important criteria:

- Market size

- Level of competition

- Demand for Java in the job market

- Product market fit pre-assessment

- Team expertise

- Market complexity in terms of legal, financial, and bureaucratic issues

We translated the interface of the CodeGym website as well as the first two levels of the course into the language of the countries in which we planned to launch, and then checked a few more parameters:

- Translation quality

- User activity in the product

Launch in Europe and problems with distribution in China

We launched 12 local versions and found that the mini-versions of CodeGym are best perceived in Poland, Germany, France, and China. We also learned that China was the leader in all metrics of engagement in learning. However, the markets of European countries were relatively similar to our own, while in China, we immediately faced some difficulties.

We began our journey to Tianxia along a seemingly proven path: launch advertising, look at metrics, conduct surveys, and draw conclusions. However, even launching ads in China is not that easy.

So, what difficulties can an experienced marketer have when creating an advertising office? With Google, Facebook, Quora, or LinkedIn, there really were no problems. However, to create an advertising account in Chinese products Baidu, WeChat, Weibo, Douyin, QQ, or Tencent, oh, how difficult it is if you are out of China!

On some advertising platforms in China, foreign companies cannot create an advertising office, especially if your company is related to education. On others, this can be done, but you need to go through countless checks, confirmations, calls, prepare tons of documents that need to be signed with hieroglyphs, take a photo with completed questionnaires, and much more. In short, only a very serious company can do this.

Unsurprisingly, these features weakened our enthusiasm. Since there were other promising areas, we decided that the obstacles in China were too high and the market was difficult; we decided to postpone the work in China for now.

And yet, China!

Six months have passed since the successful launch in Europe, but we still did not lose focus on China. Within the framework of collecting information, we realized that it is Asia, in principle, that is the current market driver for Ed-Tech’s growth, mostly China and India. There are about 900 million Internet users in China. Users spend an average of 3 hours per day browsing content online and actively researching educational opportunities abroad.

According to a study by the Chinese media platform JMDedu, the majority of parents in major cities in China spend at least $ 7,000 per year on children’s education.

China’s EdTech market sector provides stable venture capital flows. China is the leader in investment in EdTech.

Also, it can be noted that online education is one of the fastest-growing industries in China. In 2015, the number of online education users in China was 110 million, with a market value of 114 billion yuan.

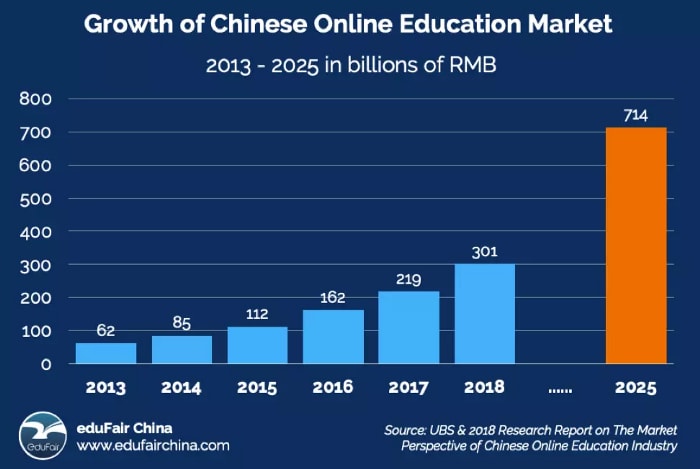

By 2018, the number of online students grew by 63% to 179 million, and the market value doubled to 300 billion yuan ($45.6 billion). This trend is expected to continue in the future; UBS estimates the market will grow to 714 billion yuan ($108 billion) by 2025.

The size of the online education market in 2020 was $203 billion. In 2021, it is likely to be $223 billion, and in 2025, the online education market will grow to $341 billion (average annual growth of 9.23%).

According to forecasts, due to COVID-19, these numbers may change, and in 2025, we will receive not $350 billion but $404 billion.

This market is already taken! Are you sure?

The statistics looked very promising, especially considering the positive response we received from our test course. However, as part of the Market Research of the programming market in China, it turned out that there are already a significant number of companies and products that have completed insane rounds of investments and have grown to a scale that is difficult to imagine. The main players in the online education market in China are Yuanfudao, Zuoyebang, Xue’ersi, and Baicizhan. Higher education and vocational training account for 75% of the total market share.

It would seem that we shouldn’t even think about competing with local companies. However, our research has shown that almost all Chinese EdTech is targeted at schoolchildren. Even college students had very few of these products, let alone adults who are considering a career change and considering becoming a software developer. Our product is aimed primarily at adults who want to change jobs, as well as students. At the same time, the Chinese are much more inclined to change jobs than, say, the Japanese or Koreans. For example, in a 2018 report, online recruiting company Zhaopin reported that more than half of its employees plan to change jobs in three years.

Do you speak Java, China?

Next, we began to investigate an important issue for us. At the moment, our platform is focused on learning only one programming language, Java. Therefore, we had to find out how popular this language is in China. We found that according to various estimates, 26.67% of all developers in China are Java developers and they have the highest salaries in the industry. It also turned out that the number of Java developers is growing by 20–30% annually, and demand often greatly exceeds supply, though these are not exact figures.

We haven’t found many interesting products to help adults learn Java. Among them were such services as Huke88 (it is somewhat similar to Udemy with a subscription), a free Alibaba course, and free video courses on Bilibili. According to reviews on Zhihu and Baidu Tieba (the Chinese counterparts of Quora), they are not very high quality and do not solve problems related to learning Java. The feedback on them was very weak, and requests from students for learning assistance were often unanswered.

We also found out that help is needed for people who have already found a job as a Java programmer. First, developers in China are a relatively young profession. The majority (56.7%) of developers in China have between 0 and 3 years of experience. Second, 71.8% of Chinese developers were trained in this profession at university, and, according to surveys, this training did not give them the appropriate skills and knowledge. Therefore, they often learn while working independently. Naturally, this category speaks English quite well, but nevertheless, a good Chinese course will not be superfluous.

First 3,000 users and registration problems

Summing up all the information received, we decided to continue our tryings for the Chinese market. However, due to the problems described above, we could not fully concentrate on it and instead decided to work with it on a leftover basis. So, we wrote several answers mentioning CodeGym on Zhihu, published a number of articles about the product on popular Chinese platforms, and sent out press releases to the Chinese media. During the first week, there were no reactions from the media and few transitions to the site, so we decided to postpone the idea of expansion for a while and think about other approaches. However, 4 months after the events described above, I looked at the metrics for various products. When I looked into the Chinese version of CodeGym, I found about 3,000 registered users there. Most of them have already passed free localized levels and solved all the problems. In the comments, there were many requests for access to the rest of the course.

We monitored local websites related to learning programming, and it turned out that CodeGym was mentioned quite often. At the same time, there were many complaints on the forums about difficulties with registration and a lot of popular “life hacking” posts about how to create an account on CodeGym. There was a problem that we had no idea about: when registering via email, we opened Google-captcha, but it was banned in China, so we had difficulty using email for registration. All social networks that can be used for login also do not work in China (sure, we knew this, but decided to leave this method just in case). In short, of all the possible ways in the country, only registration through GitHub worked.

Of course, we immediately removed the Google captcha and localized 18 more course levels. Fortunately, the process has already been debugged.

It’s alive…but really risky!

The audience’s response was impressive. Reach up to level 20 of the course, the time users spend inside the product, and other metrics were exactly two times higher than similar CodeGym metrics in any other regions of the world.

At that moment, we realized that we could try to tackle this area more seriously.

We identified a set of risky assumptions in which, with each subsequent failure, the rest of the work with China would not make any sense.

The list of risky assumptions was something like this:

- We won’t be able to provide Chinese users with a really convenient way to register on the website (as a foreign company, we won’t be able to implement registration through WeChat or other convenient registration methods).

- We won’t be able to pass verification and access at least one advertising network in China (for example, Baidu, WeChat, Douyin, etc.).

- Metrics from other channels (such as paid ones) will show lower results than traffic from Zhihu and articles that users wrote themselves. If the metrics are significantly lower than in Poland, Germany, and the United States, but the cost of advertising is about the same, then the unit economics will not converge.

- Since we are a foreign company, we won’t be able to accept payments from China (for example, we won’t have some kind of license and we simply will not be able to connect WeChat Pay, AliPay, and UnionPay).

- China users won’t buy our paid product.

- We won’t be able to scale our distribution channels and grow rapidly in revenue.

Results

In the end, we tested all the risky assumptions, and given that all this was done without using many resources, it was not easy. We can write an entire guide to test each one and tell many fascinating stories.

For example, just like when registering a developer account on WeChat, every day for 2 weeks at 5 am I was woken up by calls from China with new requests to send photos with documents and questionnaires. Or, there’s a story about how we added payment through Chinese payment services, turned on Paymentwall, and were surprised that there were no payments at all with excellent engagement rates.

However, the most important thing is that we coped with these difficulties, and the product began to work successfully. Well, the main thing that pleases us is that the metrics of the Chinese locale of CodeGym walkthrough are, on average, twice as high as in other locales. For example, the first level of the course is passed by approximately 52% of registered Chinese users, 24% for US users, 34% for Russian users, and 25% for the Polish CodeGym version.

Of course, the real expansion is still very far away, but the first results are already pleasing to us. We currently have 23,400 registered users in the Chinese locale on our website. This number is constantly growing; we sell subscriptions to Chinese users every day. Chinese users write great reviews about us, and we plan to develop further in this market.

First. published at Entrepreneur's Handbook.

Top comments (0)