The cryptocurrency market is one of the most volatile financial ecosystems, making it both highly lucrative and incredibly unpredictable. Traditional trading strategies, which rely on human intuition and technical analysis, often struggle to keep up with the rapid fluctuations and emerging trends. This is where Artificial Intelligence (AI) steps in, offering traders powerful tools to enhance decision-making, automate trades, and predict market movements more accurately.

AI-driven trading systems analyze vast amounts of data in real-time, recognize patterns, and execute trades based on predefined algorithms. By integrating AI with crypto trading, traders and investors can reduce risks, optimize their portfolios, and gain deeper insights into market sentiment. In this blog, we will explore how AI is transforming crypto trading, its role in market predictions, and what the future holds for AI-powered trading strategies.

Understanding AI in Crypto Trading

Artificial Intelligence is reshaping the way crypto markets operate by bringing automation, precision, and data-driven insights into the trading space. Unlike human traders, AI can process large datasets, analyze price movements, and execute trades within milliseconds.

How AI is Used in Crypto Trading

Pattern Recognition: AI scans historical data to identify recurring trends and patterns that influence market fluctuations.

Real-time Data Processing: AI-powered algorithms analyze news, social media sentiment, and blockchain transactions to predict price movements.

Risk Management: AI helps traders manage risk by setting stop-loss and take-profit strategies based on market conditions.

Automated Trading: Trading bots execute buy and sell orders automatically, minimizing emotional biases and human errors.

By leveraging AI, traders can make more informed decisions while reducing manual effort and emotional biases in trading.

How AI Enhances Market Predictions

Predicting market movements in the crypto space is challenging due to the market’s high volatility. However, AI enhances accuracy in market forecasts by utilizing data science and machine learning techniques.

Key AI Methods for Crypto Market Predictions

Machine Learning Models: These models analyze historical price trends and trading volumes to predict future price movements.

Sentiment Analysis: AI scans social media platforms, news articles, and online discussions to gauge market sentiment and its potential impact on prices.

Predictive Analytics: AI-based tools generate price forecasts using statistical models and regression analysis.

AI-driven market predictions help traders anticipate price fluctuations, detect market cycles, and optimize entry and exit strategies.

AI-Powered Trading Bots & Automation

AI trading bots have become a game-changer in the crypto world, allowing traders to automate their strategies and execute trades 24/7 without human intervention.

How AI Trading Bots Work

Rule-Based Trading: Bots execute trades based on predefined conditions, such as moving averages and technical indicators.

High-Frequency Trading (HFT): AI bots analyze market conditions and execute multiple trades within seconds to capitalize on small price movements.

Arbitrage Trading: Bots identify price differences between exchanges and execute trades to exploit these gaps.

Although AI bots offer efficiency, traders must monitor them regularly to adjust strategies and avoid potential risks associated with market unpredictability.

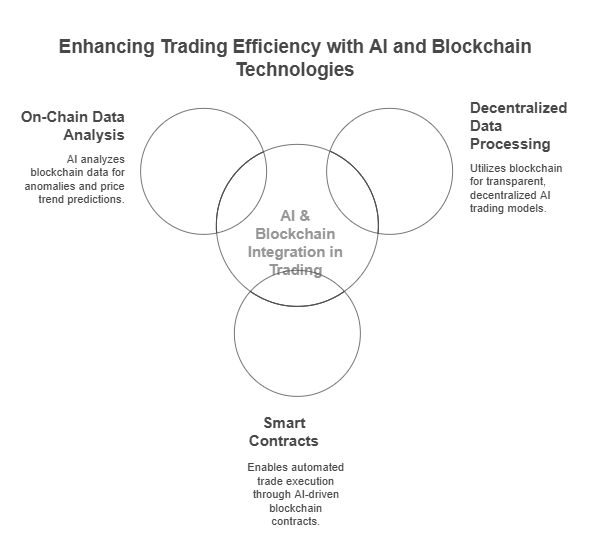

AI & Blockchain Integration in Trading

The combination of AI and blockchain is revolutionizing crypto trading by enhancing security, transparency, and decentralization.

How Blockchain Supports AI in Trading

Decentralized Data Processing: AI-powered trading models utilize blockchain to ensure transparency and eliminate centralized control.

Smart Contracts: AI-driven smart contracts enable automated trade execution without the need for intermediaries.

On-Chain Data Analysis: AI analyzes real-time blockchain data to detect anomalies, track transactions, and predict price trends.

Blockchain ensures that AI-powered trading remains transparent and tamper-proof, reducing fraud and manipulation risks.

The Future of AI in Crypto Trading

The fusion of AI and crypto trading is still evolving, but the future looks promising. Upcoming advancements include:

AI-Driven Decentralized Finance (DeFi): AI will further optimize DeFi protocols, enhancing lending, staking, and liquidity management.

Personalized AI Trading Assistants: AI-powered assistants will offer real-time market insights tailored to individual traders.

Self-Learning Trading Bots: Future AI models will learn from market conditions and continuously improve their trading strategies.

AI-Powered Fraud Detection: AI will help identify and prevent suspicious trading activities, reducing fraud risks.

As AI continues to evolve, its integration with blockchain and crypto trading will create smarter, faster, and more efficient markets.

Conclusion

AI is revolutionizing crypto trading by bringing automation, predictive analytics, and intelligent decision-making into the industry. From algorithmic trading to sentiment analysis and portfolio optimization, AI is making trading more efficient and accessible. When combined with blockchain’s transparency and security, AI-driven crypto trading has the potential to reshape financial markets. As technology advances, we can expect AI to play an even greater role in driving innovation and efficiency in the crypto space.

Top comments (1)

Interesting!