Disclosure: I’m part of the team at RevenueCat, where we help app developers track and optimize revenue across iOS, Android, and beyond. This post is based on our annual State of Subscription Apps report, which this year analyzes data from over 75,000 apps and $10 billion+ in revenue.

If you’re building or scaling a subscription app in 2025, RevenueCat’s latest State of Subscription Apps report has some eye-opening insights for you.

Onboarding is (Still) Everything

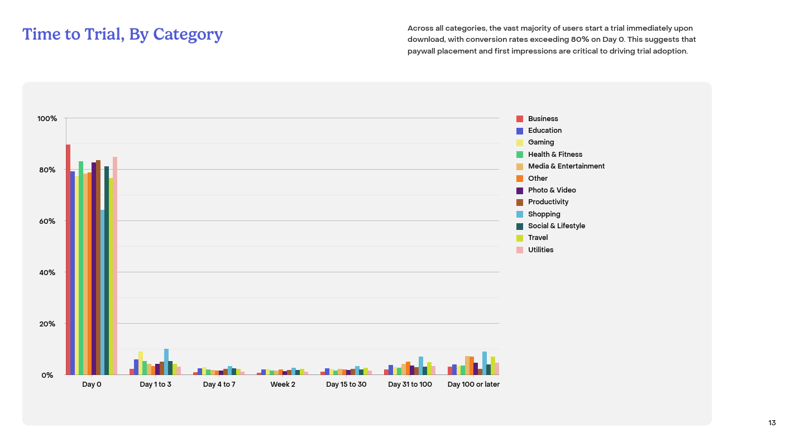

The data confirms what many devs already suspect: the first 24 hours are everything. A staggering 82% of all free trial conversions happen the day the user installs the app. Miss that window, and you’re likely losing them for good.

So what’s working? Successful apps lead with immediate value and introduce their paywalls early. The days of waiting until a user’s third session to prompt for a trial are over. Whether it’s an onboarding wizard, interactive tutorial, or simply a paywall after the first meaningful interaction, the top-performing apps don’t delay.

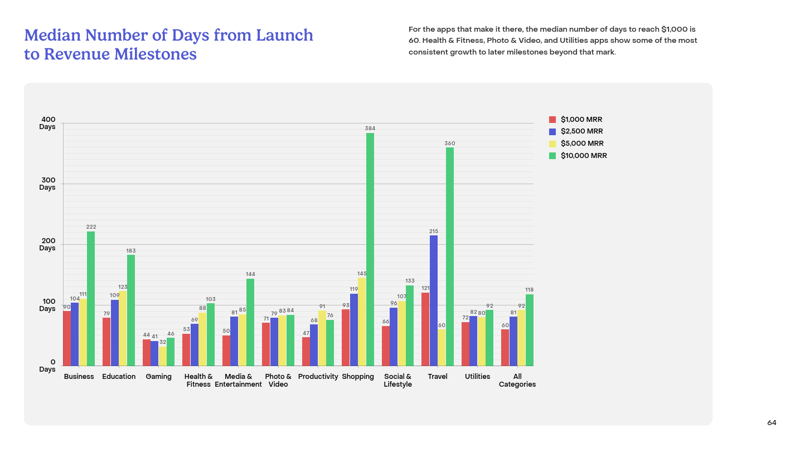

Games Scale Faster—But With Risks

Another insight from the report: games hit revenue milestones faster than most other categories. For example, games typically reach $10K/month far quicker than productivity, fitness, or media apps. This aligns with the hit-driven nature of mobile gaming. When a game resonates with users, it often goes viral and scales rapidly.

But games also churn users quickly. Developers need to balance launch-focused UA (user acquisition) strategies with mid-funnel retention mechanics to avoid burning through budgets.

Health & Fitness = High Revenue, High Refunds

The Health & Fitness category consistently outperforms most others in terms of revenue per download, but it comes with a twist: refund rates are also unusually high. Users often overcommit to new habits (think New Year’s resolutions) and later request refunds.

The takeaway? If you’re in this space, invest in user engagement and retention workflows to keep people active and feeling progress early—before refund remorse sets in.

iOS Still Dominates (But Web Billing is Rising)

North American developers still make the bulk of their revenue on iOS—75%+ of total revenue for many apps comes from Apple’s ecosystem. However, the report shows a growing trend of apps using web billing to capture high-intent users.

More apps are now funneling audiences from email lists or social media to web-based checkout flows before the user ever installs the app. This helps bypass app store fees and gives developers direct access to customer data.

Pricing & Retention Go Hand in Hand

One final nugget: lower-priced apps retain users at higher rates. While higher-priced apps can still succeed, retention rates drop as prices rise. The report suggests that many successful apps balance premium pricing tiers with lower-cost entry points (e.g., freemium or lite plans).

For developers, the lesson is clear: obsess over the onboarding funnel, and experiment with monetization strategies to extend retention.

Top comments (0)