As a freelance web developer, it recently dawned on me that I had never given any thought to my pension. After all, at thirty years old, retirement is still a couple of decades away. But I know that being a freelancer comes with the responsibility of having to take care of my own pension, and I don’t want to end up as a retiree without any income. So I set out on a quest to improve my financial well-being and be better prepared for the future.

In this article, I share the most important principles that I’ve successfully applied to my own financial life.

The importance of financial planning

Money is as important in our lives as food and having a place to sleep. We use it every day and we can’t live without it. Yet, most of us have never learned how to manage it well. When I look back at my own education, I realized that I was never taught how to manage my money, how to fill in my taxes, etc… These are very important life skills and it astonishes me our school systems do not teach them.

We’ve all heard stories of people who ended up in a precarious financial situation, often caused by an unexpected event: they lost their job, they’ve been diagnosed with an unexpected illness, had a costly repair to their house… To use Nassim Nicholas Taleb’s words, such events are “black swans”: they come as a surprise and have a major effect. You might think that your life will be safe of black swans, but that is the whole point: they always come unexpectedly and can happen to anyone.

So the goal of planning your personal finance is simple: to avoid ending up in financial trouble, and to improve the financial situation of your future self. It all starts with acquiring the right knowledge, and fortunately for us, there are only a couple of basic principles that underlie it all!

Spend less than you make

“The ultimate secret to personal finance is quite simple: spend less than you make.” — Andy Rachleff

Spending less than you earn is the most important principle. It’s common sense! Still, you’d be surprised at the number of people who live beyond their means. It’s fine to go in debt under some circumstances, for instance when buying a house. But otherwise, you should only spend the money that you actually possess.

As developers, we are fortunate that we generally make a good living compared to people in other industries. After all, we have skill sets that are currently in high demand. Unless you have a lavish lifestyle or have unusually high costs, you should be able to live within your means.

Measure then optimize your spending

“To measure is to know.” — Lord Kelvin

Optimizing your spending is a bit like software optimization. Similarly like how you shouldn’t randomly improve the performance of parts of your code without knowing where the actual bottlenecks are, you need to actually understand your spending habits before you can make good changes.

Tracking all of my spending for about 3 months helped me substantially in getting the bigger picture of my financial situation. When you know what you spend your money on every month, you have the data necessary to reduce your spending. Figure out what expenditures really are important to you and try to reduce spending money on things that don’t add much to your life. Maybe you will find out that you spend a lot on eating out, so start by cutting down on your outings to restaurants. On the other hand, if you’re a food lover, you might want to keep spending money on restaurants because those times are vital to your happiness.

It’s important to decide on those trade-offs for yourself. You’re the only person who knows what things contribute to your happiness.

Invest your savings in index funds

Once you’ve optimized your spending, you’re left with all that excess money every month. What do you do with it?

Most people would put it into a savings account. However, savings accounts are far from optimal when you’re saving for the long term. In both the US and the EU, interest rates have been extremely low for the past decade. As I’m writing this in May 2019, the interest rate set by the European Central Bank is exactly 0.0%. This causes the returns on a savings account to be very low. Much lower than inflation, in fact, which means that you’re losing buying power every year that your money is in a savings account.

History has shown that you can achieve drastically higher returns by investing your savings. However, the smart investor does not try to beat the market by investing in individual stocks. Indeed, as amateur investors we can never compete against expert Wall Street analysts who spend their entire day analyzing companies. You might make a couple of good investments here and there, but over the long run it’ll be very difficult and time-consuming to sustain high returns.

Instead, we invest in index funds. An index is like a bag of stocks. When you invest in an index fund, you own a little bit of each company in the index. The most famous index is the S&P 500, which consists of the 500 largest American companies. The MSCI World index is another well-known one. It contains stocks of over 1,600 companies from the developed markets (US, Europe, Australia, Japan,…). So instead of investing in a handful of stocks, you invest in the entire stock market. This approach of investing is called passive investing, because you don’t have to spend time managing your portfolio of investments. You just invest in the index fund and let it be.

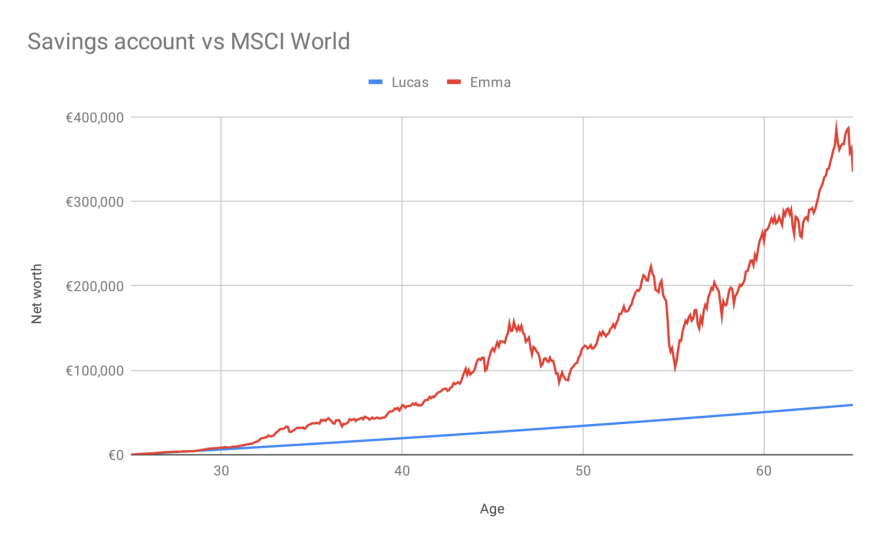

Let’s benchmark the return of a passive investing strategy against a savings account. Imagine Lucas and Emma, who are both about to retire at 65 years old. They started working at the same age, 40 years ago when they were 25. For all these years, they’ve consistently been saving $100 every month. There’s one difference: Lucas didn’t know anything about investing so he put all of his hard earned savings into a savings account with a steady annual return of 1%. On the other hand, Emma was fortunate enough to have learned about passive investing when she was a student. Because of that, she has been putting her monthly savings into an index fund tracking the MSCI World index.

Let’s see how the size of their savings has evolved during their lifetime.

By age 65, both Lucas and Emma will have put aside the same amount of €48,000. With the steady 1% interest that he gets from his savings account, Lucas will have grown this to €58,989. In the meantime, Emma’s savings have grown to a staggering €335,185! This is over 5 times more than what Lucas has, and all she had to do was deposit her savings into an index fund rather than into her savings account.

Looking at the evolution of Emma’s savings, you see that it has swings up and down. These are unavoidable as financially markets inevitably go up and down. For instance, during the 2008 financial crisis, the stock market lost half its value, and so did the index. But when you spread out your investment over 30 or 40 years, you have the time to recuperate any major losses. This makes passive investing ideal for saving for your retirement.

Finally, you don’t have to just take my word for it. Warren Buffett himself, the most successful investor of the past decades, says that index funds are the best investments for most people.

Conclusion

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett

As developers, we are fortunate to generally be well-paid compared to the general population. However, this doesn’t mean that we can live a financially irresponsible life. The two principles outlined in this article are the foundation for your financial well-being:

- Reduce your expenses by only spending money on things that contribute to your happiness.

- Invest your savings in index funds rather than leaving them in a savings account.

There’s a lot more to learn on the topic, especially on investing. But let this be a start. How do you manage your finances and better prepare for the future? Leave your comments below.

Yoran is the CTO and co-founder of Curvo, where he improves the financial well-being of millennials through passive investing. The finance world is filled with jargon, complicated financial “solutions”, horrible stock photos of old men in suits and clunky apps. In contrast, Enzo brings simplicity and transparency, and requires no financial knowledge to start investing.

Top comments (1)

As developers, you’re already equipped with problem-solving skills and logical thinking—two valuable traits that can be leveraged to build financial stability and wealth. However, understanding personal finance might not come as naturally as coding.